On Thursday we made another world first! A live multi-speaker event directly from INSIDE our platform. And again it went perfectly, and will be the start of many more to come. I’ve got it looping in the LIVE area of the TV app in the platform so you can take a look.

And like the last two weeks, today you can also watch this OVI Market Review INSIDE the platform as a Video ON DEMAND!

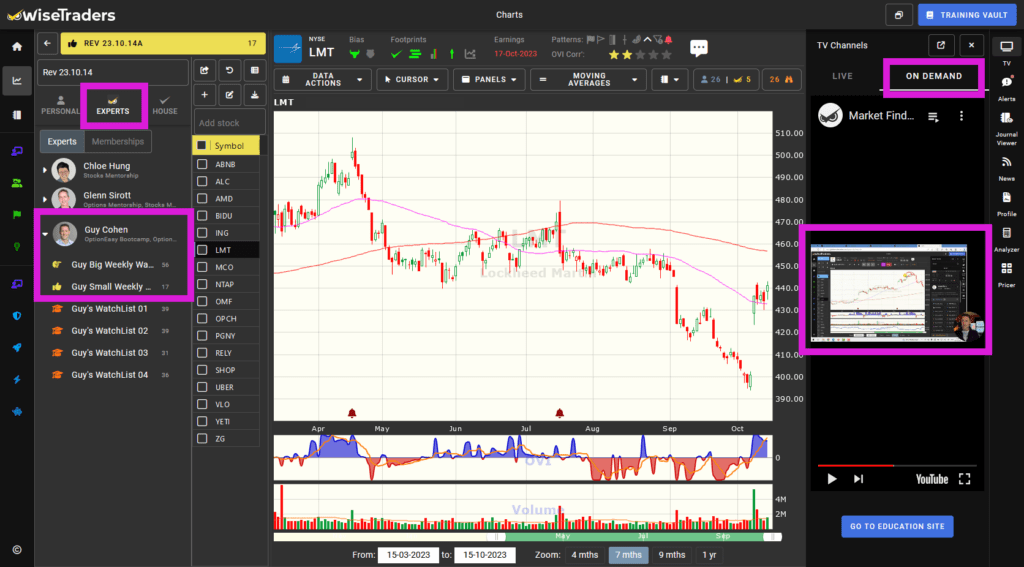

How to Watch This Video

- Log into the members area: https://members.wisetraders.com

- Click on Platform (top right)

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

If you have multiple screens, you can pop out the video by mousing over the video itself where you’ll see a “picture-in-picture” icon, and if you only have one screen you can watch it next to the charts or maximize the video window to full screen. That’s your choice!

Like last week, I’m putting today’s reviewed stocks into my (Guy’s) Expert Watchlist area. That means the big list and the more condensed list.

Now for the markets …

We nailed the first three days of last week, as they continued the upward momentum bounce. Then Thursday the market ran out of puff as a bond auction failed to deliver, and Friday couldn’t maintain its promising start to the day.

With earnings having kicked off, it’s likely to be a very choppy few weeks.

So, be super fussy. Many stocks are not behaving optimally, so you must “read the room”. The room is not so friendly right now, so be happy to be patient. Most trading mistakes come through a lack of patience.

Again, our Market Timing at least nailed the first few days of the week, and having a grasp of this can only help you improve.

That’s why I’m including our Market Timing service (OVI Markets Daily) with our Stocks Summit VIP membership. That’s a $2,364 bonus … for FREE.

Follow this link for details.

And just in case you skimmed over it earlier … Please be fussy and focus on clear Big Money Footprints near Key Levels. It is absolutely the best way to trade.

Market Outlook:

After a predictable bounce, the market looks week and poised for downside. The only “hope” is that earnings contains bullish surprises. JPM and WFC gapped up initially on their annoucements, but closed at their lows on Friday.

Watch the video for more detail.

The Main Indices:

The S&P has rebounded up off its 200-dma, while the QQQ has hit its head on its 20-dma with the 50-dma not far ahead.

The SPY, QQQ and DIA look like imminent waterfalls, while the IWM is looking even weaker.

Market Timers:

- Longer Term Market Timer (OVIsi):

Turned red due to the Indices Machine Learning component dropping hard after Friday’s close. - Medium Term Swing Timer:

Emerging weakly out of oversold and bearish. Not enough juice to be encouraged about. - Index OVIs:

The DIA, QQQ and SPY OVIs have flirted with a bit of blue, with the QQQ being the most encouraging, but more red is more likely unless earnings surprises en mass. The IWM has been the easiest to read by far, being unambiguously red.

Fast Filters Stock Selection:

Again, we’ll be light on nuggets this week, so focus on those high quality setups near Key Levels.

One of the filter combos I used today was on my own static watchlists, combing them with activity near the Key Levels.

Of all the Big Money Footprints, the three most important are OVI, Shrinking Retracements, and Key Levels. The others are also very helpful, but those three are the ones I look for first in the VIP section.

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look. Very soon I will only post this in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video so you know what my sentiment is on each stock listed.

Software Upgrades:

Live and on-demand TV is working well. Next project is the improved journal app and calculator.

Moving forward, we’ll be deploying the charts upgrade, which will pave the way to the broker API by popular demand, and also full mobile phone (portrait) optimization. Lots to do!

Many more game-changing upgrades will be made in time for the London Stocks Summit on December 2nd.

Stay in touch to discover more as we unveil best-of-breed applications!

Events:

Our Stocks Summit in London on 2nd December will be the most practical ever, and with the most bonuses ever.

Each session will have a practical exercise for you to complete, so you can build your confidence in finding the exact type of setup you want to focus on. These practicals will include Market Timing and specific stock strategies, and will only take 15-minutes for you to complete. This will give you the confidence to use our tools to their maximum potential while saving you huge amounts of time.

We’ll have the Foundation Day online the Saturday before the big event so we can focus on more of these practicals during the event.

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.