Just two weeks until our big Orlando Bootcamp! Get ready for further chart upgrades/fixes and new “toys” for attendees in the next few days that will transform the speed at which you can find optimal options ideas … literally in a single click directly from the charts!

Yesterday was the Foundation Day where I went through the basics and theory behind options. We recorded it, so even if you missed it but want to attend the Bootcamp, you can view it later on.

In two weeks’ time the two-day event will emphasise the PRACTICAL! You’ll be using our new tools, guided by me and my team where each exercise is easy to follow step-by-step.

Plus, we’re releasing a brand new education suite that has been two years in the making. Here you’ll be able to cement your knowledge with state-of-the art fun learning tools – including quizzes! – all at your own pace.

Onto the markets …

Now … over the past few weeks I’ve mentioned we need to see something more dramatic like a monorail reversal bar etc in order to feel more confident of an imminent and meaningful pullback.

Thursday’s action was that bar. Now, although Friday took back a large proportion of those losses, we do now have a baseline level of support.

Remember what I said last week:

“March 15th seemed to herald a long-awaited pullback, but the market had other ideas and there was no downward follow-through.

That tells me we’re likely going to need a very strong reversal signal for a meaningful pullback to happen.“

See below for Market Outlook.

Another reminder, to ensure you keep getting my reviews and communications, please register for our Telegram channel here.

https://t.me/wisetradersovi

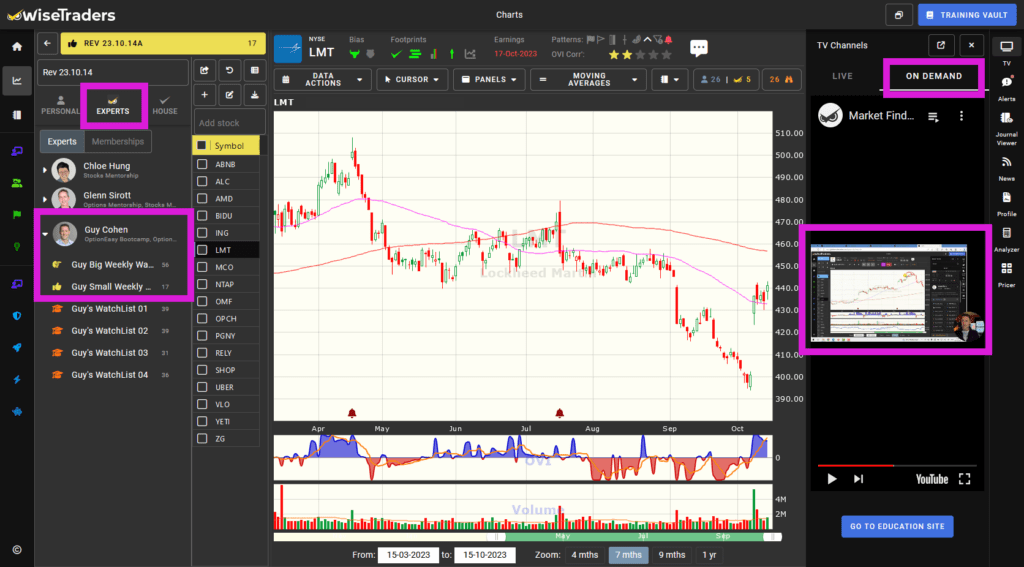

How to Watch This Video:

The best way to watch this video so you can flip through the charts at the same time:

- Log into the members area: https://members.wisetraders.com

- Click on Platform (top right)

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

** These Market Reviews will change soon. Please keep an eye out for this in the coming weeks. **

Market Outlook:

Watch the video for more detail.

While there may be a few twists and turns to come, it looks like Thursday’s bearish monorail bar will set the scene for a decent pullback.

Our market timing is a real strength that few others possess. Being good at market timing enables you to swim WITH the tide. It’s a crucial skill set for which I’ll have an update at the Orlando Options Bootcamp in April.

The Main Indices:

Some tangible signs of wobbling, though ironically the IWM has held up the best … so far!

Now you know why I’ve been repeating the mantra of protecting your existing profits and any new profits early.

If you did this, then Thursday’s action would not have hurt terribly at all.

Keep sticking with our game plan of AAA setups near Key Levels.

Don’t get distracted by missed opportunities.

Market Timers:

- Longer Term Market Timer (OVIsi):

Green. - Medium Term Swing Timer:

Just about bullish, and not overbought - Index OVIs:

Red apart from the IWM, which is neutral to blue.

Fast Filters Stock Selection:

This week I’ve focused on consolidations and Shrinking Retracements.

An exciting finding is that Shrinking Retracements have now been proven to provide real quantitative substance.

So, along with the OVI that’s another concept and algo, unique to us, that has proven empirical merit.

This is very powerful stuff.

Remember a chart needs to have the right qualities in order for you to consider trading it.

Pick your game and stick to the best quality setups that conform to it.

My game is OVI, near Key Levels, Shrinking Retracements, and a consolidation/sideways move. The other two Big Money Footprints are desirable but those four are essential to ME!

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** The list of stocks is in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video commentary so you know what my sentiment is on each stock listed. **

Software Upgrades:

The new charts have been released with some new functions also being deployed inside them, including a few indicators. Over time we’ll add indicators to them – even though I personally won’t use them.

In time for the Options Bootcamp we’ll also be adding the Fast Filters TradeFinders to the charts. Imagine that … You’ll be able to filter for stocks and options from INSIDE the charts! Following that:

- A link to a broker platform from the enhanced Journal app directly from the charts to make life much easier for you.

Imagine knowing if an options trade is in line with or violates your stated risk parameters!

We’ve already built the calculator engine, it just needs to be deployed. - More indicators to choose from inside our OVI charts …

Not so much for me personally, but I know many members do like to play!

Also, the full mobile phone (portrait) optimization is in the plan for the summer. Lots to do!

Many more game-changing upgrades will be made in time for the Orlando Options Bootcamp on April 20-21.

Events:

Our Options Bootcamp in Orlando on 20-21 April will be the most practical ever, with around 20 exercises and with the most bonuses ever.

Like we just did in London, each session will have a practical exercise for you to complete, so you can build your confidence in finding the exact type of setup you want to focus on. These practicals will involve all the options strategies covered, with each one taking only a few minutes to complete. This will give you the confidence to use our options tools to their maximum potential while saving you huge amounts of time.

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.