Yesterday we held another live webinar directly from INSIDE our platform. Again it went down a storm, and this time with no first-time wrinkles!

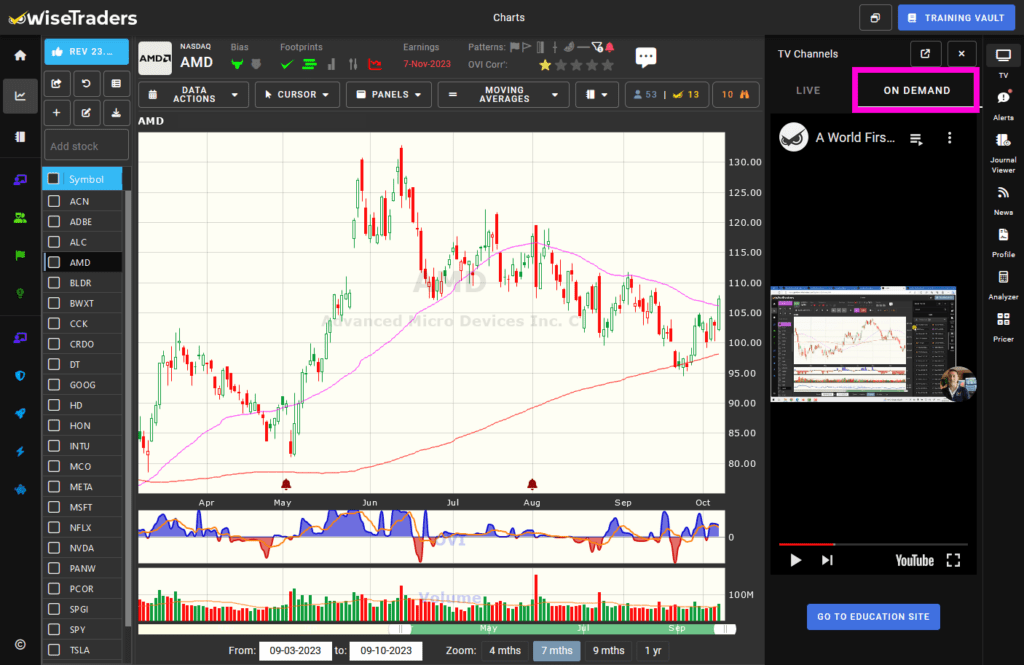

And like last week, today you can also watch this OVI Market Review INSIDE the platform as a video on-demand!

How to Watch This Video

- Log into the members area: https://members.wisetraders.com

- Click on Platform (top right)

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

If you have multiple screens, you can pop out the video by mousing over the video itself where you’ll see a “picture-in-picture” icon, and if you only have one screen you can watch it next to the charts or maximize the video window to full screen. That’s your choice!

Also, I’m putting today’s reviewed stocks into my (Guy’s) Expert Watchlist area. That means the big list and the more condensed list.

Now for the markets …

As suggested last week, the markets did still have room to the downside despite being oversold, but once the S&P hit its 200-dma, the market reversed with a strong bullish monorail yesterday.

That suggests the larger stocks are likely to be resilient in the short term, though pickings are quite slim right now.

And once again, our Market Timing continues to be exceptional, providing huge value.

That’s why I’m including our Market Timing service (OVI Markets Daily) with our Stocks Summit VIP membership. That’s a $2,364 bonus … for FREE.

Follow this link for details.

I repeat this every week, but it’s worth saying again: Be fussy and focus on clear Big Money Footprints near Key Levels. It is absolutely the best way to trade.

Market Outlook:

The market is oversold and now ready to put in some upside work.

Watch the video for more detail.

The Main Indices:

The S&P has rebounded up off its 200-dma, while the QQQ has hit its head on its 20-dma with the 50-dma not far ahead.

The DIA and IWM are bouncing back toward their 200-dmas, with the DIA likely to reach its 200-dma soon.

Friday’s bullish momentum bars suggest short term strength.

Market Timers:

- Longer Term Market Timer (OVIsi):

Still amber and likely to stay that way for a while. - Medium Term Swing Timer:

Bearish and oversold, but likely to be out of that zone within the next couple of days. - Index OVIs:

The DIA, QQQ and SPY OVIs are all moving steeply from negative readings to neutral / mildly positive ones. THE IWM remains deep red.

Fast Filters Stock Selection:

Again, we’ll be light on nuggets this week, so focus on those high quality setups near Key Levels.

Of all the Big Money Footprints, the most important are OVI, Shrinking Retracements, and Key Levels. The others are also very helpful, but those three are the ones I look for first.

Last week I showed you the power of combining a momentum bar with the Big Money Footprints, and there are many examples of that paying off over the past few days. VIP members can use this filter, and today I’ll show you how.

Go to the Platform for the lists of stocks (a) that I cover, and (b) that warrant a closer look. Very soon I will only post this in our new Expert Watchlists area, so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video so you know what my sentiment is on each stock listed.

Software Upgrades:

Live and on-demand TV. We’ll keep improving the technology as we go along, and keep adding more essential functions too.

Moving forward, we’ll be deploying the new Journal app calculator, and then the charts upgrade, which will pave the way to the broker API by popular demand, and also full mobile phone (portrait) optimization. Lots to do!

Many more game-changing upgrades will be made in time for the London Stocks Summit on December 2nd.

Stay in touch to discover more as we unveil best-of-breed applications!

Events:

Our Stocks Summit in London on 2nd December will be the most practical ever, and with the most bonuses ever.

Each session will have a practical exercise for you to complete, so you can build your confidence in finding the exact type of setup you want to focus on. These practicals will include Market Timing and specific stock strategies, and will only take 15-minutes for you to complete. This will give you the confidence to use our tools to their maximum potential while saving you huge amounts of time.

We’ll have the Foundation Day online the Saturday before the big event so we can focus on more of these practicals during the event.

Watch today’s market review inside the members area here!

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.