How to Watch This Video

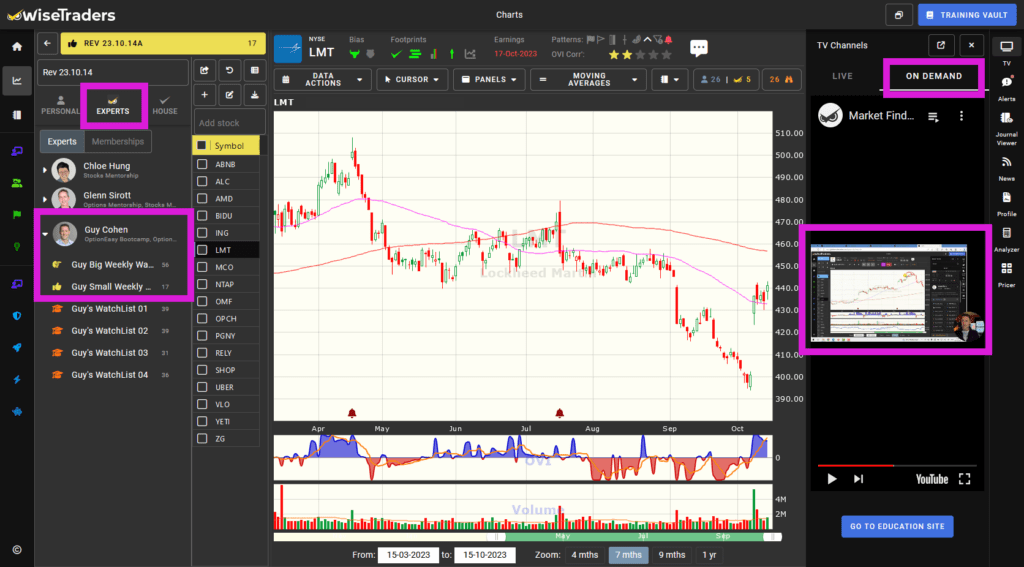

- Log into the members area: https://members.wisetraders.com

- Click on Platform (top right)

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

If you have multiple screens, you can pop out the video by mousing over the video itself where you’ll see a “picture-in-picture” icon, and if you only have one screen you can watch it next to the charts or maximize the video window to full screen. That’s your choice!

Like last week, I’m putting today’s reviewed stocks into my (Guy’s) Expert Watchlist area. That means the big list and the more condensed list.

Now for the markets …

Or should I say, “put”!

Last week’s guidance was bearish and the market responded will full force.

As I review last week’s stock commentaries, with nearly all bearish guidances, it only reinforces that we must be among the very best stock market analysis services anywhere.

If you’re not paying attention to my regular market overviews, you’re surely missing out on the best value there is to be had.

** Please note these market commentaries will no longer be widely available very soon, and you will need to be in our VIP area. **

Follow this link to make sure you don’t miss out.

Now, it’s worth mentioning that we can’t always have strong convictions as to market direction. But when we do it’s going to be for solid reasons, and our EDGE trading plan will minimise any risk if we were to get it wrong.

That’s the beauty of the WiseTraders system.

This week the markets look set for more volatility and general weakness as more earnings reports are released. The S&P is now dipping under its 200-dma, and much will depend on its behaviour from here. If earnings is weak among the big giants, a continued downdraft followed by a retracement and waterfall is a likely scenario.

What’s certain is that last week’s guidance that this earnings would be choppy is spot on.

Again, be super fussy and be happy to be patient. Trading mistakes often come through a lack of patience.

Our Market Timing is priceless, and having a grasp of this can only help you improve.

That’s why I’m including our Market Timing service (OVI Markets Daily) with our Stocks Summit VIP membership. That’s a $2,364 bonus … for FREE.

Follow this link for details.

Market Outlook:

After the predicted downdraft, the market continues to look weak with more volatility and downside likely. As with last week, the only “hope” is that earnings contains bullish surprises. This time it’s the turn of the big guns like MSFT, GOOG, META, AMZN.

Watch the video for more detail.

The Main Indices:

Last week I said “The SPY, QQQ and DIA look like imminent waterfalls, while the IWM is looking even weaker“.

Here’s what happened: The S&P has breached its 200-dma to the downside, the QQQ has failed at its 50-dma, the DIA has failed at its 200-dma, and the IWM is oversold with more weakness likely.

Market Timers:

- Longer Term Market Timer (OVIsi):

Red. - Medium Term Swing Timer:

Bearish. - Index OVIs:

Last week I mentioned red was likely with all the indices which had flirted briefly with blue, and that’s exactly what’s happened. The DIA, QQQ, IWM and SPY OVIs are all different levels of red, and are likely to stay in a similar vein unless MSFT, GOOG, META and AMZN can give encouragement.

Fast Filters Stock Selection:

We’ll be light on nuggets this week, so focus on those high quality setups near Key Levels, or even just watch the fun unfold.

One of the filter combos I used today was on sector ETF component stocks where the sector ETF and the individual stocks are showing bearish Shrinking Retracements.

I also repeated my filter for my static list stocks near Key Levels.

Of all the Big Money Footprints, the three most important are OVI, Shrinking Retracements, and Key Levels. The others are also very helpful, but those three are the ones I look for first in the VIP section.

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** Very soon I will only post this in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video so you know what my sentiment is on each stock listed. **

Software Upgrades:

Big News! We’re going to prioritize the new charts so we can have a link to a broker platform. Even if in the first stage this is packaging up a bracket order for you, that will have a massive impact in terms of saving time.

The journal app upgrade and calculator will go after that.

Also, the full mobile phone (portrait) optimization is on the docket. Lots to do!

Many more game-changing upgrades will be made in time for the London Stocks Summit on December 2nd.

Stay in touch to discover more as we unveil best-of-breed applications!

Events:

Our Stocks Summit in London on 2nd December will be the most practical ever, and with the most bonuses ever.

Each session will have a practical exercise for you to complete, so you can build your confidence in finding the exact type of setup you want to focus on. These practicals will include Market Timing and specific stock strategies, and will only take 15-minutes for you to complete. This will give you the confidence to use our tools to their maximum potential while saving you huge amounts of time.

We’ll have the Foundation Day online the Saturday before the big event so we can focus on more of these practicals during the event.

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.