Further upgrades last week including weekly options in the Analyzer and Pricer applications.

The new Help facilities will roll out tomorrow, and we’ll update the videos as we go along. As you’ve see, the pace of our upgrades is faster than the videos we can create around them!

The TradeFinder from the charts full deployment is only a few weeks away, and that will be another game-changer. You’ll already notice little improvements we made last week, including a Search Bar for the Fast Filters, and access to your own Fast Filters. Next will be the full TradeFinder functionality right there. I estimate that will reduce the time to do my (and your!) searches by around 70%.

Onto the markets …

With respect to the pullback from the highs, we seem to have judged that perfectly, with our 5-8% range being uncannily accurate.

Last week I suggested that the markets were likely to remain rangebound between March’s high and April’s low for the immediate future.

In just five days, we’re already getting close to testing those highs! As the title says, ‘Trade What You See’ (TWYS) looks bullish but there is a but’, and the but I’m referring to is not 100% tangible. This is what makes my market timing analysis so difficult to translate completely into a quant algo.

This week I do see a number of decent setups – mostly post-earnings – with many having already played out well from last week and previous weeks.

See below for Market Outlook.

Another reminder, to ensure you keep getting my reviews and communications, please register for our Telegram channel here.

https://t.me/wisetradersovi

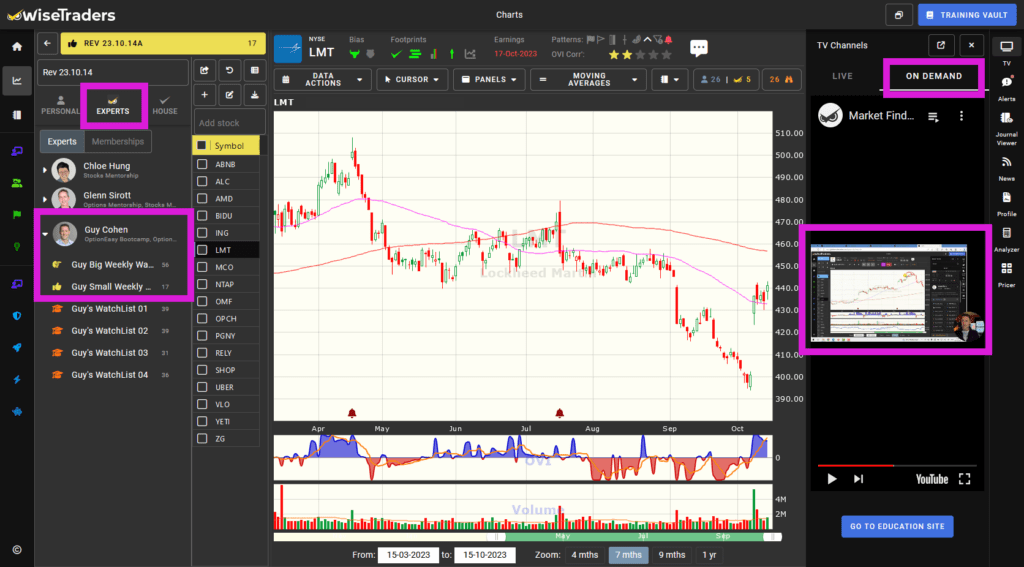

How to Watch This Video:

The best way to watch this video so you can flip through the charts at the same time:

- Log into the members area: https://members.wisetraders.com

- Click on Platform (top right)

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

Market Outlook:

Watch the video for more detail.

Post earnings has been largely positive, particularly where OVI has featured. And there are more post-earnings setups occurring, with bulls outgunning the bears.

On the face of it, the recent index highs are under pressure, particularly with heavyweights like AAPL and the other Big Seven apart from TSLA having a strong couple of weeks.

This is where the ‘but’ comes into play. I can’t quite put a finger on it, but going by experience, after such a prolonged bullish run from October to April, some form of sideways gyration would be more ‘normal’ behavior.

As ever, we just have to play each trade by its merits, so be cautious with your P1 profit targets … Protect them quickly.

In summary, there is upside potential, but don’t take it for granted as one twitch could spark a nasty whipsaw.

Our market timing is a real strength that few others possess. Being good at market timing enables you to swim WITH the tide.

The Main Indices:

All the indices rose through their 50-dmas last week. Stocks consolidating above that Key Level with positive OVIs and other supporting Big Money Footprints are worth focusing on.

Keep sticking with our game plan of AAA setups near Key Levels.

Don’t get distracted by missed opportunities.

Market Timers:

- Longer Term Market Timer (OVIsi):

Half green. - Medium Term Swing Timer:

Bullish. - Index OVIs:

All blue apart from the IWM which is neutral.

Fast Filters Stock Selection:

This week I’ve focused on post-earnings setups with OVI consolidations and other Big Money Footprints, especially near Key Levels and with Shrinking Retracements.

Remember a chart needs to have the right qualities in order for you to consider trading it.

Pick your playbook and stick to the best quality setups that conform to it.

My playbook is OVI, near Key Levels, Shrinking Retracements, and a consolidation/sideways move. The other two Big Money Footprints are desirable but those four are essential to ME!

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** The list of stocks is in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video commentary so you know what my sentiment is on each stock listed. **

Software Upgrades:

More fixes and tweaks this past week.

The Gift Area (top right of the Platform) has been received very well, as have the Personal Fast Filters in the Chart TradeFinder area.

You can now search for the filters with the Search Bar, and full functionality of the TradeFinders is coming very soon to this area.

After that, journaling from the charts which will pave the way for:

- A link to a broker platform from the enhanced Journal app directly from the charts to make life much easier for you.

Imagine knowing if an options trade is in line with or violates your stated risk parameters!

We’ve already built the calculator engine, it just needs to be deployed. - More indicators to choose from inside our OVI charts …

Not so much for me personally, but I know many members do like to play!

Also, the full mobile phone (portrait) optimization is in the plan for the summer, and more dynamic notifications from inside the application will follow that. Lots to do!

Many more game-changing upgrades will be made in time for the London Stocks Summit on December 7th.

Events:

Our Stocks Summit in London on 7th December will be the most practical ever, with half of the event dedicated to practical exercises and with the most bonuses ever.

Like we just did in Orlando, each session will have a practical exercise for you to complete, so you can build your confidence in finding the exact type of setup you want to focus on. Easily by the event, all your TradeFinder activities will be directly from the charts, saving you huge amounts of time.

The Options Bootcamp recordings are up now and organised into their relevant chapters for easy viewing.

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.