Please ensure you keep getting my reviews and communications by being in our Telegram channel here.

https://t.me/wisetradersovi

Greetings from Italy during what’s been a hectic week of … work!

The Platform update snagging is almost complete, and we’re already working on the next important upgrades, including a way of simplifying and speeding up the process of finding a good trade to pushing an order token to a broker platform. This includes researching what else is out there, and carefully managing privacy data responsibilities and data integrity.

The good news is that my regular research check-ins have dramatically sped up thanks to our new upgrades … it’s easily 50% quicker now the TradeFinder is inside the charts. I’m using my Fast Filters and then quickly adapting them as I go along.

This enables me to conduct more searches in quick time if I’m so inclined.

The markets …

In today’s broadcast you’ll see how the markets have been a mixed bag this past week. We’ve had good winners from our classic setups, but there have also been false breakouts.

As I’ve mentioned over the last few weeks, conditions continue to be sub-optimal. That said, they are far from catastrophic as you’ll see from the good number of solid setups that behaved as expected.

Again, you should see the importance of striking when a stock looks hot near a Key Level … and we’ll soon have improved filters to this end.

Continue to be the lion! Don’t become a headless chicken just because you missed one.

See below for Market Outlook.

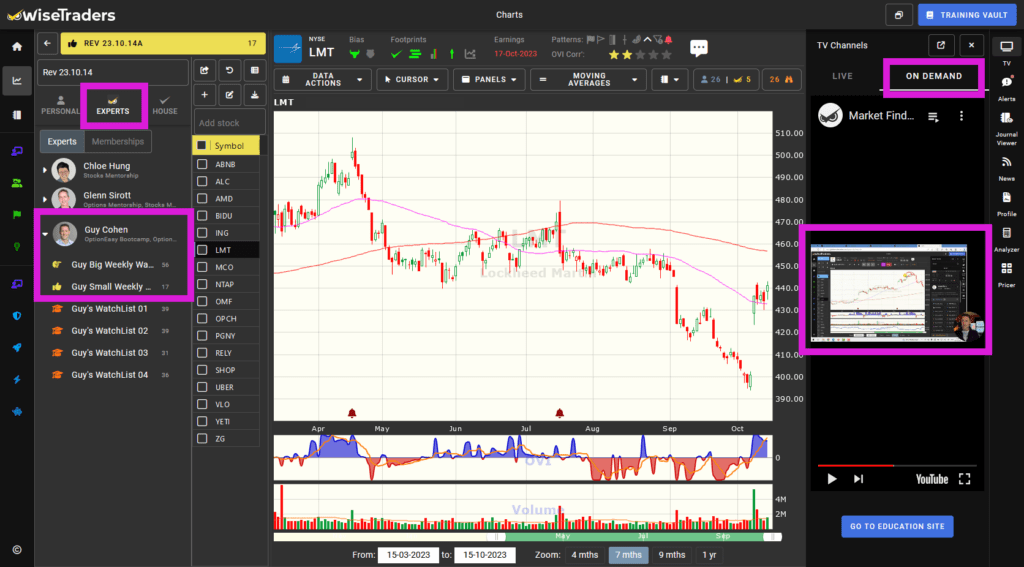

How to Watch This Video:

The best way to watch this video so you can flip through the charts at the same time:

- Log into the members area: https://members.wisetraders.com

- Click on Platform (top right)

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

Market Outlook:

Watch the video for more detail.

The SPY and QQQ encounteree a sell-off bar on Thursday, which they partly recovered from on Friday.

The DIA broke out beautifully from its consolidation as highlighted last week, but the big surprise was the Russell 2000 (IWM), which gapped up from out of nowhere on Thursday.

This suggests further evidence of stock/sector rotation which I mentioned recently.

As mentioned last week, the signs are looking marginally positive for earnings season, but it will be a very mixed bag.

Quality is in short supply, so at least that gives us fewer setups to focus on.

Our market timing is a real strength that few others possess. Being good at market timing enables you to swim WITH the tide.

The Main Indices:

As expected from last week, the DIA did have upside potential, and broke out nicely. Conversely, the IWM produced a big upside surprise.

We now have a peculiar situation where all the main indices could be considered overbought!

The conundrum for us is that we lean towards markets and setups near Key Levels (I personally gravitate to the 50- and 200- dma’s).

So, while the indices would benefit us if they could form a quick pullback, in the meantime we’ll keep focusing on stocks that are consolidating near their own Key Levels.

Ultimately tricky conditions prevail, so be cautious and fussy … particularly with so much news being released in the coming weeks. Be ready with the big guns for when there are friendlier conditions.

Market Timers:

- Longer Term Market Timer (OVIsi):

Green. - Medium Term Swing Timer:

Bullish. - Index OVIs:

All the main indices are blue.

Fast Filters Stock Selection:

Again I benefited hugely from our recent upgrades, which enabled me to complete my research in record fast time.

In the next few weeks we’ll have a webinar where I’ll go through all my shortcuts and time-saving hacks that the new Platform enables us to enjoy.

Remember, quality beats quantity. Even with our amazing new technology, a chart still needs to have the right qualities in order for you to consider trading it.

Pick your playbook and stick to the best quality setups that conform to it.

My playbook is OVI, near Key Levels, Shrinking Retracements, and a consolidation/sideways move. The other two Big Money Footprints are desirable but those four are essential to ME!

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** The list of stocks is in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video commentary so you know what my sentiment is on each stock listed. **

Software Upgrades:

We’re still cleaning up the snagging items, and it’s all gone smoothly considering the scale of the upgrade. Soon we’ll deploy the updated ‘How To’ video guides, and there’ll also be a handy ‘How To’ clickthrough guide to help you navigate the platform.

Next up is the journaling from the charts which will pave the way for:

- A link to a broker platform from the enhanced Journal app directly from the charts to make life much easier for you.

Imagine knowing if an options trade is in line with or violates your stated risk parameters!

We’ve already built the calculator engine, it just needs to be deployed. - More indicators to choose from inside our OVI charts …

Not so much for me personally, but I know many members do like to play!

Also, the full mobile phone (portrait) optimization is in the plan for the summer, and more dynamic notifications from inside the application will follow that. Lots to do!

Many more game-changing upgrades will be made in time for the London Stocks Summit on December 7th.

Events:

Our Stocks Summit in London on 7th December will be the most practical ever, with half of the event dedicated to practical exercises and with the most bonuses ever.

Like we just did in Orlando, each session will have a practical exercise for you to complete, so you can build your confidence in finding the exact type of setup you want to focus on. Easily by the event, all your TradeFinder activities will be directly from the charts, saving you huge amounts of time.

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.