You may have seen by now that our new Gift area is on the Platform. This is where I’ll be posting some nuggets in pdf or video format to enhance your experience, help you stay on the path and clarify what we do and why it works. And once in a while it might be something a little “out there” to make you think!

Onto the markets …

Last week’s forecast of a choppy earnings was accurate, with market direction being ambiguous. This week we need to see if there’s any follow through from Friday’s bounce. Until then it’s premature to commit to a definitive market direction.

One of the first filters I go through is Consolidations … and just like last week the vast majority aren’t great this week either.

But then applying other filters such as OVI Correlation, Shrinking Retracements, Key Levels, and other Big Money Footprints individually, then I get to focus on more interesting setups quickly.

As per last week there are a few decent individual setups that we can look into more closely. Several played out very well, including BIDU and BABA, which we highlighted uncannily, though their gap-ups made entries tricky.

And as I’ve mentioned over the past few weeks, my expectation that this market pullback would NOT turn into a capitulation looks well judged.

See below for Market Outlook.

Another reminder, to ensure you keep getting my reviews and communications, please register for our Telegram channel here.

https://t.me/wisetradersovi

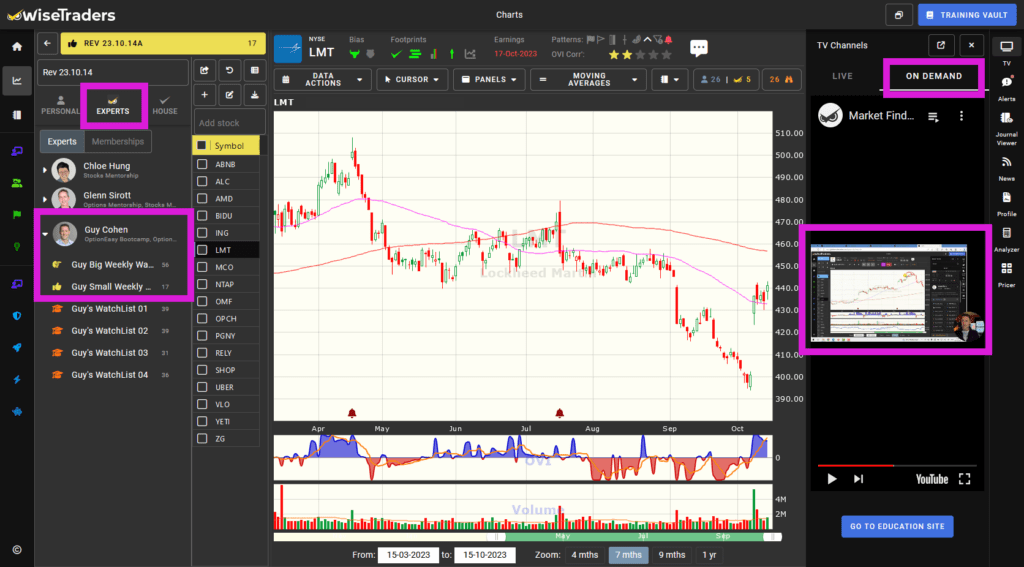

How to Watch This Video:

The best way to watch this video so you can flip through the charts at the same time:

- Log into the members area: https://members.wisetraders.com

- Click on Platform (top right)

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

Market Outlook:

Watch the video for more detail.

Friday’s bounce needs more context, so for now – like last week – I’m minded to focus on individual post-earnings scenarios where the stock has tipped its hand as to most likely direction.

Our market timing is a real strength that few others possess. Being good at market timing enables you to swim WITH the tide.

The Main Indices:

All the indices bounced up last week, touching their 50-dmas on Friday and closing just below them. This indicates tentative resistance but not profound, so I expect more activity around these levels.

Keep sticking with our game plan of AAA setups near Key Levels.

Don’t get distracted by missed opportunities.

Market Timers:

- Longer Term Market Timer (OVIsi):

Half green. - Medium Term Swing Timer:

Neutral but moving out of bearish territory. - Index OVIs:

Pretty much neutral apart from SPY which has swung into the blue.

Fast Filters Stock Selection:

This week I’ve focused again on post-earnings setups exhibiting OVI, consolidations near Key Levels and Shrinking Retracements.

Remember a chart needs to have the right qualities in order for you to consider trading it.

Pick your playbook and stick to the best quality setups that conform to it.

My playbook is OVI, near Key Levels, Shrinking Retracements, and a consolidation/sideways move. The other two Big Money Footprints are desirable but those four are essential to ME!

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** The list of stocks is in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video commentary so you know what my sentiment is on each stock listed. **

Software Upgrades:

A number of fixes and tweaks this past week.

The main big ones have been the Gift Area (top right of the Platform) …

… and also your Personal Fast Filters are now available directly from the charting area. Just click on the Binoculars icon in the Watchlist Area, select the TradeFinder from the dropdown list, and you’ll then see a “Personal” tab that you can click.

Very soon, the full TradeFinder capability will be available from the charts, saving huge amounts of time for all of us!

After that, journaling from the charts which will pave the way for:

- A link to a broker platform from the enhanced Journal app directly from the charts to make life much easier for you.

Imagine knowing if an options trade is in line with or violates your stated risk parameters!

We’ve already built the calculator engine, it just needs to be deployed. - More indicators to choose from inside our OVI charts …

Not so much for me personally, but I know many members do like to play!

Also, the full mobile phone (portrait) optimization is in the plan for the summer, and more dynamic notifications from inside the application will follow that. Lots to do!

Many more game-changing upgrades will be made in time for the London Stocks Summit on December 7th.

Events:

Our Stocks Summit in London on 7th December will be the most practical ever, with half of the event dedicated to practical exercises and with the most bonuses ever.

Like we just did in Orlando, each session will have a practical exercise for you to complete, so you can build your confidence in finding the exact type of setup you want to focus on. Easily by the event, all your TradeFinder activities will be directly from the charts, saving you huge amounts of time.

The Options Bootcamp recordings are up now and will soon be organised into their relevant chapters for easy viewing.

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.