I hope you had a wonderful Christmas, and I wish you a very happy New Year.

It’s my strong belief that 2024 will see a bullish market, and you know how good we are at market timing, so if you do have any resolutions to make, make it that you’re going to stay in touch with the markets!

Just a reminder to Stocks VIPs that the Summit event video is all up now, and neatly organized in convenient bite-sized chapters for your easy viewing.

The exercises were such a big hit on the day, that we’ll be doing even more of them in our Orlando Options Bootcamp in April.

Last week I mentioned we need confirmation before we can confidently call a pullback. Similar to last week there are indications of an overbought market, but without a clear confirmation we cannot confidently call a pullback.

Also, a quick reminder …

** Very soon, these Market Reviews will change. Please keep an eye out for this in the next couple of weeks. **

See below for the Market Outlook.

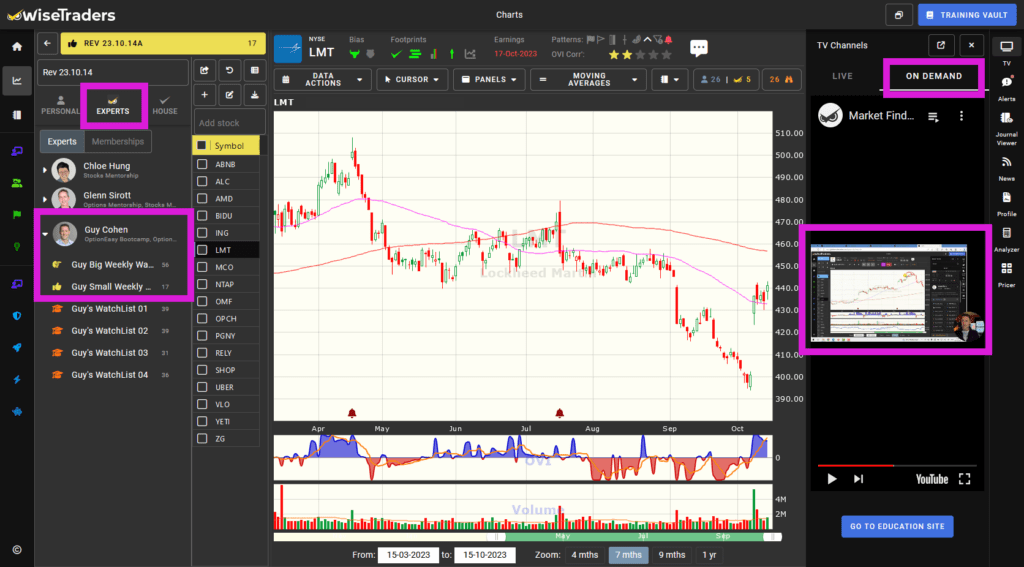

How to Watch This Video

- Log into the members area: https://members.wisetraders.com

- Click on Platform (top right)

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

If you have multiple screens, you can pop out the video by mousing over the video itself where you’ll see a “picture-in-picture” icon, and if you only have one screen you can watch it next to the charts or maximize the video window to full screen. That’s your choice!

Again, I’m putting today’s reviewed stocks into my (Guy’s) Expert Watchlist area. That means the big list and the more condensed list.

Market Outlook:

Watch the video for more detail.

So we’re still getting those warning signs including price overextension, gapping, dojis, and monorail bars but so far no confirmation as the market continues to display extraordinary resilience.

As expected during a festive season week, price action was unspectacular and inevitably sideways.

What does that mean? Well, there’re not much selling action yet, and price drift isn’t being accompanied by volume. So there could well be another hoorah in this bullish cycle, and it could even extend to the upcoming January earnings season.

As I alluded to earlier, there are many consolidations occurring right now, but the vast majority of them are from overbought levels. This tells us we’re in a serious uptrend, but that we’re due a meaningful retracement very soon.

The question is … when?

Well, that will be sometime after a proper confirmation that a top is in. And the timing of that could be any time from now to the middle of earnings season.

As we get nearer to these circumstances we can get more granular.

In the meantime just don’t be tempted by already overbought issues. Stick to our game plan – you’ve just seen how amazing it it, and I can promise you there will be many more opportunities in 2024.

When we do get the inevitable retracement, I expect it to be down to a Key Level and followed by an increasing number of Bullish Shrinking Retracement patterns, which will set the scene for further upside in 2024.

I expect this scenario to materialise during Q1 of 2024.

So, as with the last few weeks, resist the urge to chase overextended issues. Stick to the plan we talked about at the Stocks Summit. It’s serving our members brilliantly, as recounted by so many members who have transformed their own performance by following our method and using our wonderfully focused time-saving tools.

The Main Indices:

From the main indices, it’s the IWM that looks the most shaky. As with the others, it shook off its monorail bar of December 20th, made new highs, but is now looking wobbly as it has rolled over again with a long bearish bar (open high, close low).

As you know by now, the IWM – representing the Russell 2000 mid caps – tends to lag bullish markets and lead bearish markets. Worth bearing in mind.

The DIA, SPY and QQQ have all made recent new highs in the last couple of days, and given that it’s the holiday season you can’t put too much emphasis on low volume festive days.

But the fact that the market is overbought is undeniable. We just need a clear signal that this particular surge is over, and we haven’t quite got that yet.

Again, don’t chase, but do look to protect your existing profits and any new profits early.

Market Timers:

- Longer Term Market Timer (OVIsi):

Green. - Medium Term Swing Timer:

Bullish. - Index OVIs:

The SPY, QQQ, DIA and IWM have broadly positive OVIs.

Fast Filters Stock Selection:

Lots of consolidations again this week … and again the question is what kind of quality, and how far away from Key Levels are they?

Remember, of all the Big Money Footprints, the three most important are OVI, Shrinking Retracements, and Key Levels. The others are also very helpful, but those three are the ones I look for first in the VIP section. The bullish Shrinking Retracements are still quite scarce right now, but after the next meaningful pullback (and subsequent bounce), they’ll start to populate again.

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** Very soon I will only post this in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video so you know what my sentiment is on each stock listed. **

Software Upgrades:

The new charts are our priority for our next piece of development so we can have a link to a broker platform. It looks like we’ll be able to package orders from our journal app to make life much easier for you.

A further journal app upgrade and calculator will go after that.

Also, the full mobile phone (portrait) optimization is on the docket. Lots to do!

Many more game-changing upgrades will be made in time for the Orlando Options Bootcamp on April 20-21.

Stay in touch to discover more as we unveil best-of-breed applications!

Events:

Our Options Bootcamp in Orlando on 20-21 April will be the most practical ever, with around 20 exercises and with the most bonuses ever.

Like we just did in London, each session will have a practical exercise for you to complete, so you can build your confidence in finding the exact type of setup you want to focus on. These practicals will involve all the options strategies covered, with each one taking only a few minutes to complete. This will give you the confidence to use our options tools to their maximum potential while saving you huge amounts of time.

The Stocks Summit recordings are all up now and organised into their relevant chapters for easy viewing.

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.