A very Happy New Year to you, it’s going to be a great year!

A number of VIP Summit members have made me rather jolly with reports of excellent performance since that event, and only yesterday a VIP member who is a software expert expressed his appreciation that we clearly “eat our own dogfood, which is gourmet!”.

What he meant by that is that our Platform has so much care in its design it must have been built for our own in-house use as well as for members. He’s 100% correct, and it’s the ultimate compliment! And there’s much more to come in 2024!

At last the markets ran out of puff from their overbought levels as expected (apart from the DIA, but that will retrace soon enough), but with earnings around the corner I expect them to rebound.

Following this earnings I then expect a decent retracement to set us up nicely for the rest of the year with plenty of bullish Shrinking Retracements.

As I mentioned last week, I believe 2024 will see a bullish market, and you know how good we are at market timing, so if you do have any resolutions to make, make it that you’re going to stay in touch with the markets!

Also, after the success of the Stocks Summit, we’re committed to much more in the way of practical exercises, which will continue in earnest in our Orlando Options Bootcamp in April.

Finally, a quick reminder …

** Very soon, these Market Reviews will change. Please keep an eye out for this in the coming weeks. **

See below for the Market Outlook.

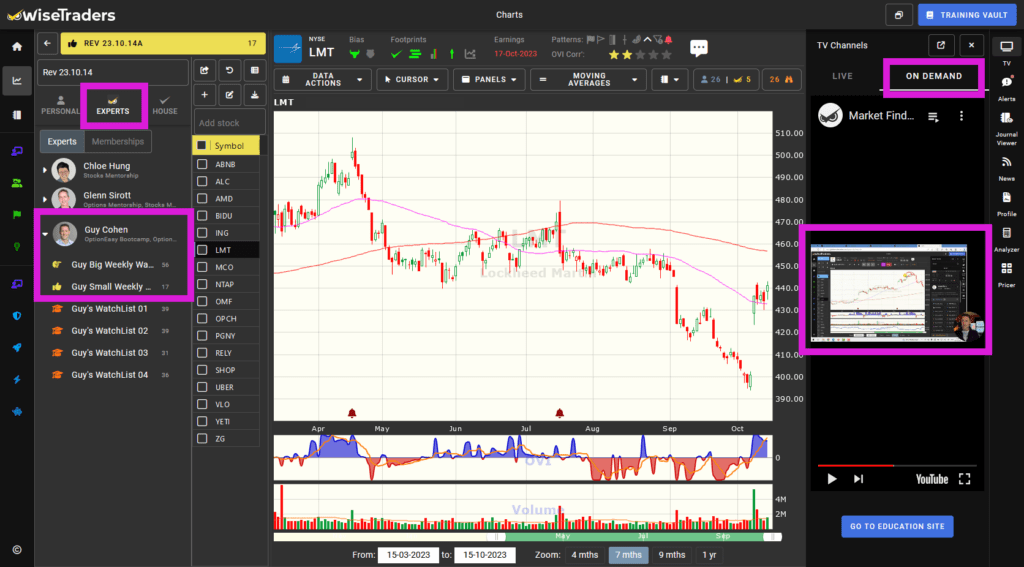

How to Watch This Video

- Log into the members area: https://members.wisetraders.com

- Click on Platform (top right)

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

If you have multiple screens, you can pop out the video by mousing over the video itself where you’ll see a “picture-in-picture” icon, and if you only have one screen you can watch it next to the charts or maximize the video window to full screen. That’s your choice!

Again, I’m putting today’s reviewed stocks into my (Guy’s) Expert Watchlist area. That means the big list and the more condensed list.

Market Outlook:

Watch the video for more detail.

So, we have expected and predicted pullback happening on the IWM, QQQ and SPY, while the DIA remains resilient for now.

With earnings imminent, the likelihood is for more bullishness and then a more “interesting” pullback thereafter, creating plenty of optimal setups for us from spring onwards.

Last week I mentioned that the plentiful consolidations looked largely overbought, and that also played out perfectly, with most failing to break out. Here’s what I said:

“As I alluded to earlier, there are many consolidations occurring right now, but the vast majority of them are from overbought levels. This tells us we’re in a serious uptrend, but that we’re due a meaningful retracement very soon. In the meantime just don’t be tempted by already overbought issues. Stick to our game plan – you’ve just seen how amazing it it, and I can promise you there will be many more opportunities in 2024.”

The Main Indices:

From the main indices, it indeed was the IWM that turned out to be the most shaky, as I mentioned it would last week. The SPY and QQQ have also retraced, but nothing particularly severe, and I’m not expecting that just yet.

As always, let the setups form, and protect your existing profits and any new profits early.

Market Timers:

- Longer Term Market Timer (OVIsi):

Half green. - Medium Term Swing Timer:

Bearish. - Index OVIs:

All the index OVIs turned red last week, though the DIA was mooted and the IWM has swung back on Friday.

Fast Filters Stock Selection:

Hardly any consolidations this week, with most of last week’s bullish patterns failing – as we suspected they would.

Remember, of all the Big Money Footprints, the three most important are OVI, Shrinking Retracements, and Key Levels. The others are also very helpful, but those three are the ones I look for first in the VIP section. The bullish Shrinking Retracements are still quite scarce right now, but after the next meaningful pullback (and subsequent bounce), they’ll start to populate again.

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** Very soon I will only post this in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video so you know what my sentiment is on each stock listed. **

Software Upgrades:

The new charts are our priority for our next piece of development so we can have a link to a broker platform. It looks like we’ll be able to package orders from our journal app to make life much easier for you.

A further journal app upgrade and calculator will go after that.

Also, the full mobile phone (portrait) optimization is on the docket. Lots to do!

Many more game-changing upgrades will be made in time for the Orlando Options Bootcamp on April 20-21.

Stay in touch to discover more as we unveil best-of-breed applications!

Events:

Our Options Bootcamp in Orlando on 20-21 April will be the most practical ever, with around 20 exercises and with the most bonuses ever.

Like we just did in London, each session will have a practical exercise for you to complete, so you can build your confidence in finding the exact type of setup you want to focus on. These practicals will involve all the options strategies covered, with each one taking only a few minutes to complete. This will give you the confidence to use our options tools to their maximum potential while saving you huge amounts of time.

The Stocks Summit recordings are all up now and organised into their relevant chapters for easy viewing.

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.