First of all, have a wonderful Christmas … It’s amazing how fast this year has gone, and by the looks of our development pipeline, the next year is also going to fly by!

By way of an early Christmas Present, when you use the new watchlist you can now flick between stocks using your up/down arrow keys. There are still a few bits to tidy up before we take it all out of Beta, but it’s getting better and better every day.

In today’s Market Review, I really had to rummage around for interesting potential plays. We must play to our strengths. Our strengths are with neat and clear setups. That is not what current market conditions are giving us many of … which means we must be patient, just as you would if you were a professional black jack player.

Try to look at a chart with the view that IT must prove itself to YOU … not you trying to wangle a trade from it. A setup should be pretty obvious. If it’s not, then you’re trying too hard to force the issue and crowbar a trade where there might not be an optimal one.

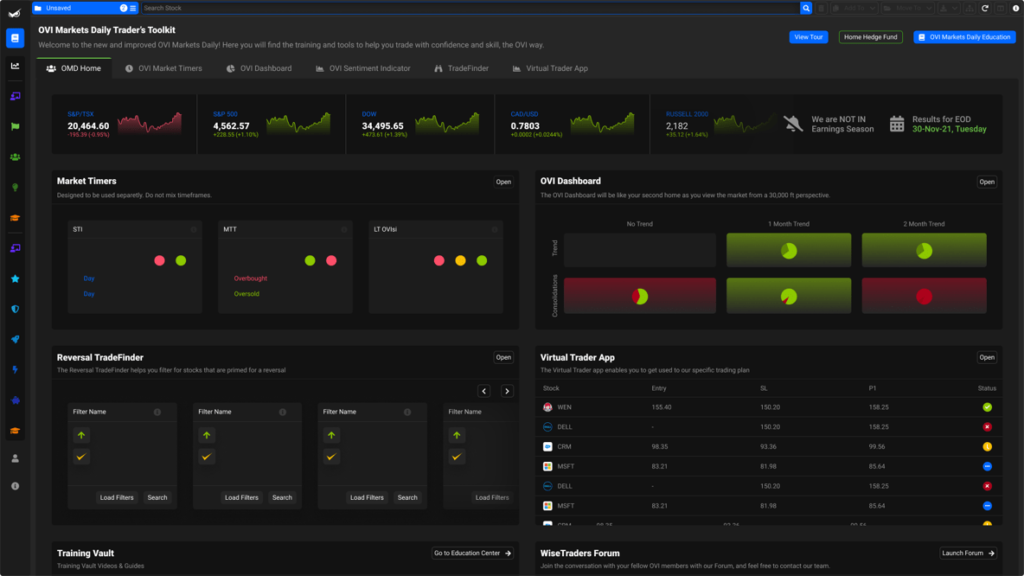

Before I get into this week’s Review, a quick glimpse into the future … This is only a first design effort for the new OVI Markets Daily site, but the gist of it is that our applications will become entirely “appy” directly from your browser.

The effect will be greater speed and efficiency, meaning we can also provide more research and insights at your fingertips and with no delays. To facilitate this we are separating the technologies that drive the education components and the application components. They will, of course, be linked, but in separate areas so they don’t interfere with each other’s performance.

In the above image you can see a more “alive” view of the markets, and the Market Timers will give you an instant view of whether there is something to do. In the next few weeks I’ll be releasing the new Short Term S&P Market Timer, which is a simple signal that will be delivered on Wednesday and Friday mornings before the open. More about that soon.

—

Three weeks ago I made a prediction for “Whipsaws”. In the 15 trading days since then, there have been at least 8 whipsaws by the S&P alone! That’s not what we’d consider to be optimal market conditions!

Today, the Medium-Term Market Timer (MTT) is sitting on its neutral line, so no comments on that.

The S&P itself is sitting on its 50-dma, which has provided such a good support so many times in 2021. Given the whipsaw’y nature of current conditions, that support line is not as compelling today as it might be if the MTT was oversold, so it’s really a case of ‘wait-and-see’ for the next day or so.

Market Outlook:

We often get an end-of-year market rally, but it’s looking iffy right now, and in any case please wait for low-risk setups, particularly in the light of the choppy behavior we’re currently witnessing.

Stock Selection:

Given that there aren’t many showing up right now, my first Filter of the day was focused on consolidations and flags. Not much there to get excited about today.

Application:

Aside from consolidations I’ve used various bullish and bearish Fast Filters, and using the new software it was a real pleasure.

You should notice it’s noticeably snappier, and while it’s still in beta, we’ve tidied up all but a few issues now. Aside from instantly seeing which Big Money Footprints and other setups are showing on the chart, one of my favorite functions is seeing which Fast Filters a stock belongs to, straight from the chart.

So, on occasions I might ask myself “Why is this stock on this watchlist?” … and now I can nearly always click on that Fast Filters link within the chart app and discover which Fast Filters the stock belongs to. Very slick!

Software Upgrades

It’s been a good week of fixes for the new applications, and once we’ve stabilized the outstanding items, we’ll flick a switch and they will instantly port over to the options TradeFinders as well. That will be another game-changer!

After all this, we’ll then set about “app’yfying” the entire experience, but all from a browser. That will also include a big upgrade for the education areas where we will optimize our interactive Learning Centre areas so we can test you as you make progress.

Again, have a wonderful Christmas, and I’ll see you next weekend for another review.

—

Remember, you can play the video at 1.25x or 1.5x speed to whizz through it faster if you like! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.