So, as predicted we did get increased volatility last week … and it manifested in both directions, pre and post Nvidia’s earnings announcement.

Now is the time to read the room – or the signs – very carefully.

Nvidia’s positive earnings caused a gap up, and all seems to be rosy in the garden … on the face of it.

But as I look at overall market structure and the quality of setups forming today, I see more of a mixed bag with bullish and bearish setups, and not a huge amount of the top quality I like to see.

That said, I still don’t see a clear signal for my anticipated pullback yet – and a clear signal is a requirement.

Another reminder, to ensure you keep getting my reviews and communications, please register for our Telegram channel here.

https://t.me/wisetradersovi

How to Watch This Video:

The best way to watch this video so you can flip through the charts at the same time:

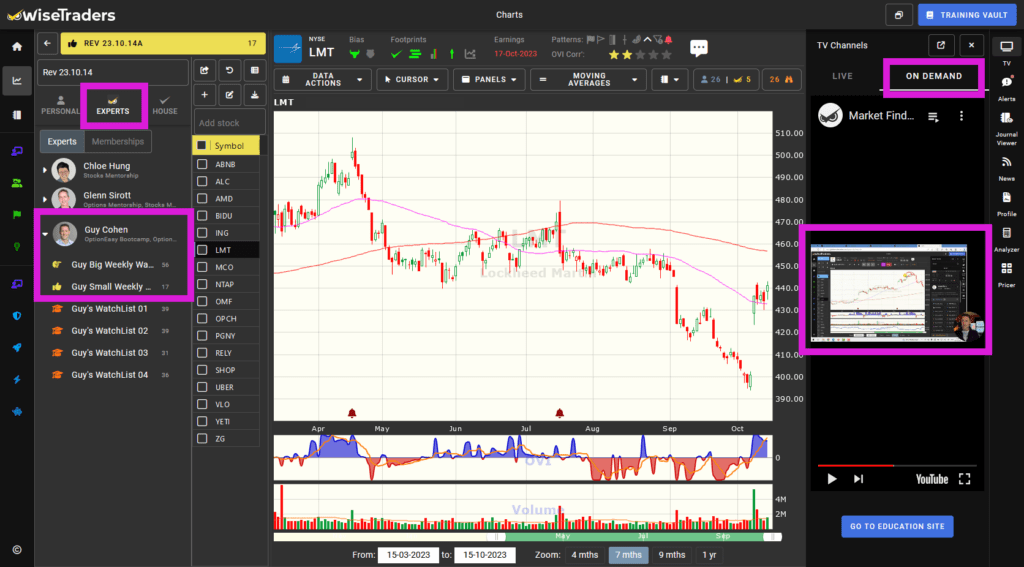

- Log into the members area: https://members.wisetraders.com

- Click on Platform (top right)

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

** Soon, these Market Reviews will change. Please keep an eye out for this in the coming weeks. **

Market Outlook:

Watch the video for more detail.

Further gyrations of heightened volatility (gaps in both directions) are likely until we get a clearer signal that a meaningful pullback is imminent.

As I mentioned last week, we do need some form of confirmation like a bearish monorail bar, railroad track or something that telegraphs the market’s intentions clearly.

This is what I wrote last week:

Right now I do anticipate increased volatility and choppiness in the short to medium term.

Following the anticipated pullback I anticipate a further bull run in the context of bullish Shrinking Retracements.

Our market timing is a real strength. Being good at market timing enables you to swim WITH the tide. It’s a crucial skill set which we’ll include in the practical exercises at the Orlando Options Bootcamp in April.

The Main Indices:

Overbought and still loving it … Now earnings is over the likelihood increases of the anticipated pullback, but as always, let our setups form properly.

Be sure to protect your existing profits and any new profits early.

Keep sticking with our game plan of AAA setups near Key Levels.

Don’t get distracted by missed opportunities.

Market Timers:

- Longer Term Market Timer (OVIsi):

Green. - Medium Term Swing Timer:

Bullish and not overbought. - Index OVIs:

Mainly blue.

Fast Filters Stock Selection:

Remember a chart needs to have the right qualities in order for you to consider trading it.

Pick your game and stick to the best quality setups that conform to it.

My game is OVI, near Key Levels, Shrinking Retracements, and a consolidation/sideways move. The other two Big Money Footprints are desirable but those four are essential to ME!

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** The list of stocks is in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video commentary so you know what my sentiment is on each stock listed. **

Software Upgrades:

We held off again last week, but a limited version of new charts should be released to PROD this coming week!

We’ve designed them to be identical to the current charts but the new technology paves the way for:

- A link to a broker platform from the enhanced Journal app directly from the charts to make life much easier for you.

Imagine knowing if an options trade is in line with or violates your stated risk parameters!

We’ve already built the calculator engine, it just needs to be deployed. - More indicators to choose from inside our OVI charts …

Not so much for me personally, but I know many members do like to play!

Also, the full mobile phone (portrait) optimization is in the plan for the summer. Lots to do!

Many more game-changing upgrades will be made in time for the Orlando Options Bootcamp on April 20-21.

Events:

Our Options Bootcamp in Orlando on 20-21 April will be the most practical ever, with around 20 exercises and with the most bonuses ever.

Like we just did in London, each session will have a practical exercise for you to complete, so you can build your confidence in finding the exact type of setup you want to focus on. These practicals will involve all the options strategies covered, with each one taking only a few minutes to complete. This will give you the confidence to use our options tools to their maximum potential while saving you huge amounts of time.

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.