I’m not a macro guy, mainly because none of the macro experts can ever agree on anything, and so much is based on interpretation in any case!

For me, Wednesday’s FOMC meeting didn’t seem like the panacea that should justify the immediate euphoric market reaction. But what I “think” is irrelevant!

In one article alone I read that GDP was expect to grow more than anticipated, but there were dangers of the economy softening … much like my brain felt after I’d read several sets of two polar opposite possibilities just a few sentences apart inside the same article!

What about inflation and jobs? And the Fed’s resulting interest rate policy?

Again, opinions and counter opinions all in the same piece, thereby rendering the article pretty unhelpful overall.

So, last week I had suggested the market needed a rest, with new highs been less likely … and the market ignored me!

To be fair, I also said “If they (new highs) are breached in the short term, I would be surprised if they held (for long)”.

Let’s see …

Luckily there was no false breakout per se, meaning no losses, but the SPY, QQQ and DIA all did make new recent highs on Thursday.

See below for Market Outlook.

Another reminder, to ensure you keep getting my reviews and communications, please register for our Telegram channel here.

https://t.me/wisetradersovi

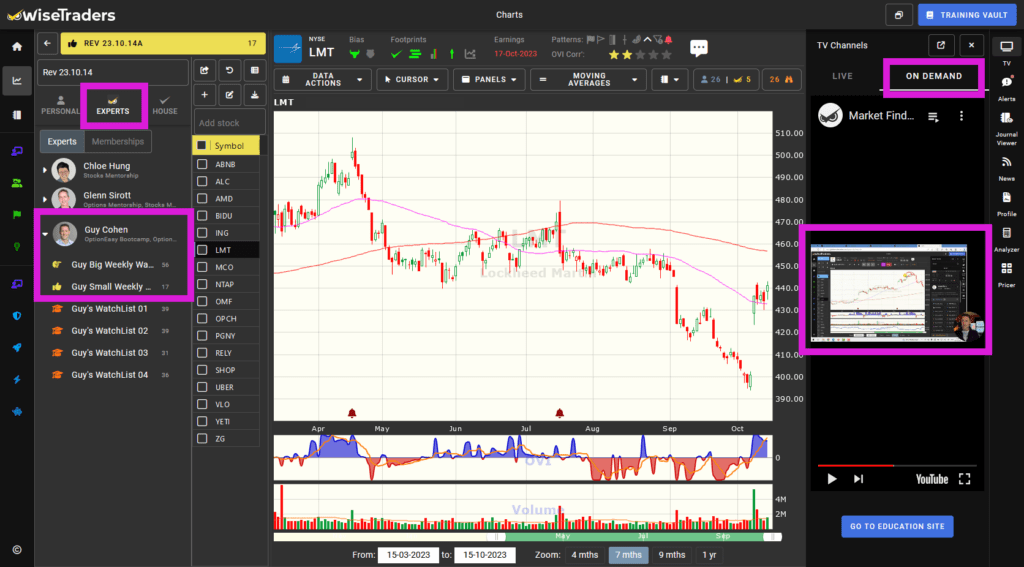

How to Watch This Video:

The best way to watch this video so you can flip through the charts at the same time:

- Log into the members area: https://members.wisetraders.com

- Click on Platform (top right)

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

** Soon, these Market Reviews will change. Please keep an eye out for this in the coming weeks. **

Market Outlook:

Watch the video for more detail.

Energy stocks broadly continued to be resilient and were joined by other sectors to give the main indices a further push up.

But as before, there are still many overbought stocks, which need to pause, while the number of really great quality bullish setups remains low.

I remain unconvinced about sustained short term upside, but I’m not going to assume a ‘Canute’ type stance in the face of reality.

All I’ll say is that any bullish trades need to be closely monitored and managed.

As ever, in the meantime, just trade what you see, and don’t try to preempt anything.

Our market timing is a real strength. Being good at market timing enables you to swim WITH the tide. It’s a crucial skill set which we’ll include in the practical exercises at the Orlando Options Bootcamp in April.

The Main Indices:

The rest phase didn’t materialize as anticipated last week. As I write this today being Friday, the market is taking a day off!

Make sure you protect your existing profits and any new profits early.

Keep sticking with our game plan of AAA setups near Key Levels.

Don’t get distracted by missed opportunities.

Market Timers:

- Longer Term Market Timer (OVIsi):

Green. - Medium Term Swing Timer:

Bullish and not overbought - Index OVIs:

QQQ wobbling. DIA, SPY and IWM all blue as of Thursday’s close.

Fast Filters Stock Selection:

With a slight time constraint, this week I’ve focused on proximity to Key Levels with OVI and other Big Money Footprints in evidence.

Remember a chart needs to have the right qualities in order for you to consider trading it.

Pick your game and stick to the best quality setups that conform to it.

My game is OVI, near Key Levels, Shrinking Retracements, and a consolidation/sideways move. The other two Big Money Footprints are desirable but those four are essential to ME!

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** The list of stocks is in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video commentary so you know what my sentiment is on each stock listed. **

Software Upgrades:

The new charts have been released with some new functions also being deployed inside them, including a few indicators. Over time we’ll add indicators to them – even though I personally won’t use them.

In time for the Options Bootcamp we’ll also be adding the Fast Filters TradeFinders to the charts. Imagine that … You’ll be able to filter for stocks and options from INSIDE the charts! Following that:

- A link to a broker platform from the enhanced Journal app directly from the charts to make life much easier for you.

Imagine knowing if an options trade is in line with or violates your stated risk parameters!

We’ve already built the calculator engine, it just needs to be deployed. - More indicators to choose from inside our OVI charts …

Not so much for me personally, but I know many members do like to play!

Also, the full mobile phone (portrait) optimization is in the plan for the summer. Lots to do!

Many more game-changing upgrades will be made in time for the Orlando Options Bootcamp on April 20-21.

Events:

Our Options Bootcamp in Orlando on 20-21 April will be the most practical ever, with around 20 exercises and with the most bonuses ever.

Like we just did in London, each session will have a practical exercise for you to complete, so you can build your confidence in finding the exact type of setup you want to focus on. These practicals will involve all the options strategies covered, with each one taking only a few minutes to complete. This will give you the confidence to use our options tools to their maximum potential while saving you huge amounts of time.

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.