I’m back home now from a wonderful visit to see our Orlando venue, which I hope you could see, is fantastic!

First, a repeat of my urgent notice from last week …

Email policies are changing with draconian measures being implemented very soon by the big email providers.

That means the likelihood of emails bouncing will sky-rocket.

My regular market timing and market reviews continue to provide you with exceptional value, so …

To ensure you keep getting my reviews and communications, please register for our Telegram channel here.

https://t.me/wisetradersovi

Over the next few days we’ll be making further recommendations for your email settings as these new protocols start to take effect.

Market Timing Improvement

We already have a ridiculously good record for market timing, which should be bringing you untold value if you’re noticing it!

But this week we made a quantum leap that will hopefully soon make its way to being available to certain members.

As you may know, we also have a quant arm which is focused on our hedge fund endeavours.

Over the past year we’ve been focusing on how Shrinking Retracements could be involved in one of our fund buckets. It’s a major undertaking due to the complexity of the algorithm.

But last week we finally made the breakthrough that makes it a goer in that environment … with the added bonus that we’ve also discovered that it might also be an interesting addition to our Market Timing capabilities.

In summary, when the Shrinking Retracements turn on, the SPY annualized return is +15%. When they’re turned off, the SPY annualized return is only +1.05%. The overall average SPY return over the last 18 years is +9.05%. So you can see just how profound this could be.

I’ll keep you posted, because we have to convert this to an equity curve, then perform some further robustness tests, and finally figure a way to deploy it. It’s a real unexpected bonus that will now be added to our existing push to automate our market timing prowess.

The Markets:

Last week I said more upside was likely to the end of earnings, but also signs that a pause would be necessary.

Wednesday saw many bearish looking railroad tracks, but in my Thursday webinar, I demonstrated that I didn’t fancy any of them.

That proved to be another great call as the markets shook off Wednesday’s down bar and powered on upwards.

All this reinforces my long held narrative that I only expect a more serious retracement after earnings season. Precisely when I won’t say just yet, but a decent sized retracement would set us up nicely for the rest of the year with plenty of bullish Shrinking Retracements.

As you can see, market timing is a crucial skill set which we’ll include in the practical exercises at the Orlando Options Bootcamp in April.

Finally, a quick reminder …

** Soon, these Market Reviews will change. Please keep an eye out for this in the coming weeks. **

See below for the Market Outlook.

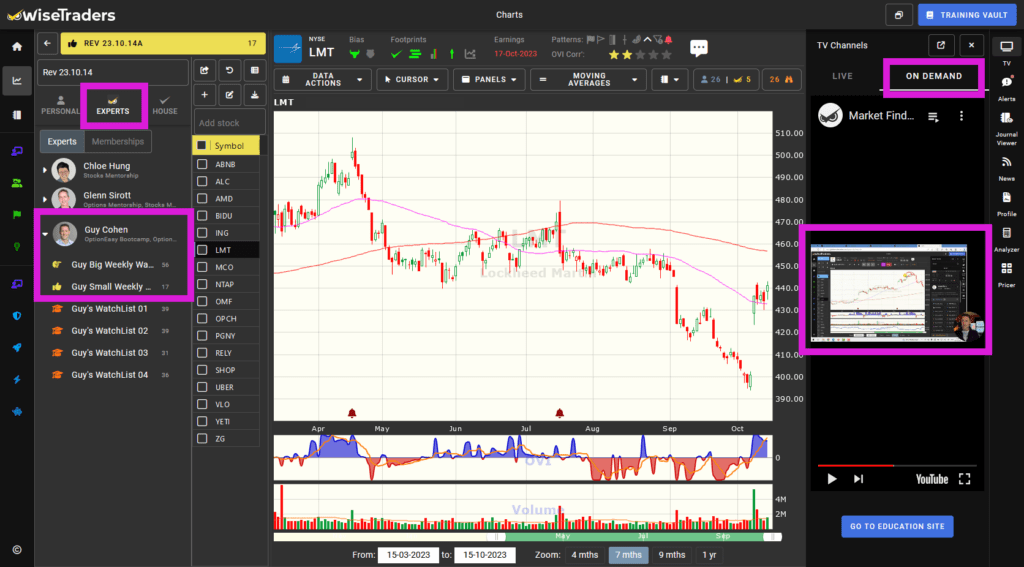

How to Watch This Video

- Log into the members area: https://members.wisetraders.com

- Click on Platform (top right)

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

If you have multiple screens, you can pop out the video by mousing over the video itself where you’ll see a “picture-in-picture” icon, and if you only have one screen you can watch it next to the charts or maximize the video window to full screen. That’s your choice!

Again, I’m putting today’s reviewed stocks into my (Guy’s) Expert Watchlist area. That means the big list and the more condensed list.

Market Outlook:

Watch the video for more detail.

The three big indices continue to enjoy being overbought while the IWM has pulled back to its 50-dma and is holding firm.

As mentioned many times over the past few weeks, the anticipated retracement will have to wait until sometime after earnings.

Keep sticking with our game plan of AAA setups near Key Levels. Don’t get distracted by missed opportunities.

The Main Indices:

As above, no downward drama expected, but last Wednesday’s action is a warning shot across the bows.

As always, let the setups form, and protect your existing profits and any new profits early.

Market Timers:

- Longer Term Market Timer (OVIsi):

Green, which bodes well for the longer term. - Medium Term Swing Timer:

Bullish and not overbought. - Index OVIs:

The SPY and DIA OVIs are positive. The QQQ OVI is emerging back into positive territory. The IWM OVI is wobbling in minor negative territory.

Fast Filters Stock Selection:

I had fun with a 121 session this morning, and noticed my mentee kept wanting to find a setup from the stocks we went through together.

As I explained to him, it should be the opposite. You should look at a stock NOT wanting to trade it. Start from that perspective. It needs to have the right qualities jumping out at you.

So, pick your game and stick to the best quality setups that conform to it. My game is OVI, near Key Levels, Shrinking Retracements, and a consolidation/sideways move. The other two Big Money Footprints are desirable but those four are essential to ME!

Remember, of all the Big Money Footprints, the three most important are OVI, Shrinking Retracements, and Key Levels. The others are also very helpful, but those three are the ones I look for first in the VIP section. The bullish Shrinking Retracements are still quite scarce right now, but after the next meaningful pullback (and subsequent bounce), they’ll start to populate again.

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** Very soon I will only post this in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video so you know what my sentiment is on each stock listed. **

Software Upgrades:

The new charts are our priority for our next piece of development so we can have a link to a broker platform. It looks like we’ll be able to package orders from our journal app to make life much easier for you.

A further journal app upgrade and calculator will go after that.

Also, the full mobile phone (portrait) optimization is on the docket. Lots to do!

Many more game-changing upgrades will be made in time for the Orlando Options Bootcamp on April 20-21.

Stay in touch to discover more as we unveil best-of-breed applications!

Events:

Our Options Bootcamp in Orlando on 20-21 April will be the most practical ever, with around 20 exercises and with the most bonuses ever.

Like we just did in London, each session will have a practical exercise for you to complete, so you can build your confidence in finding the exact type of setup you want to focus on. These practicals will involve all the options strategies covered, with each one taking only a few minutes to complete. This will give you the confidence to use our options tools to their maximum potential while saving you huge amounts of time.

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.