The stock market had an excellent run last year, with the S&P 500 up 27%. Everyone knew that this performance wouldn’t continue indefinitely and that a market correction was on the cards in 2022.

So far from November to January, we’ve seen whipsaws, signs of sector rotation, and a meaningful pullback towards long-term key levels such as the 200 day-moving average. With the kind of market action observed in the last few days, when this pullback hits, we’ll probably be looking for a “waterfall setup”.

Here’s our forecast on the overall markets in 2022, as well as our recommendations on how to best navigate them this year.

1) Increased volatility in the Short Term

There are a number of news events that are expected to move the markets this year. The following are a handful of the most important:

- FED easing tapering: The Federal Reserve has decided to reduce money supply by the middle of 2022. By the end of 2021, the markets had largely factored in this news.

- Interest rate hikes: The Federal Reserve is also expected to raise interest rates three times in 2022, according to experts. We believe the first of them will occur in Q3 rather than Q1, since the FED would be unduly aggressive to ease tapering and raise interest rates in Q1 and Q2. The US and European Central Bank have also signalled that they are not in a hurry to raise interest rates, easing some of the concerns about interest rates.

- Potential tax hike: The proposed tax hike is intended to fund President Joe Biden’s stimulus bill. This garnered lots of rejection from the Republicans, which helped ease investors’ concern about the impact of a tax hike on the markets. This news may dampen some bullish sentiment in the markets, but it will not result in a major crash.

- Supply chain disruptions: This has been an ongoing concern since the Covid-19 outbreak. Semiconductors, in particular, have been in short supply due to factories failing to open or run at full capacity. This should be resolved when economies start reopening up again once the pandemic is brought under control, possibly by the end of 2022. We therefore believe that supply chain issues will be temporary and will not cause a major disruption to the markets in 2022.

- Increased regulations in the crypto space: Cryptocurrencies have garnered a lot of of attention in recent years, with a growing number of businesses, such as banks and online payment providers, accepting them as a form of payment. We expect the crypto space to undergo a huge transformation this year, and increased regulations will likely be one of the outcomes. This may produce some whipsaws among crypto-related stocks such as Paypal, Mastercard, Visa, Marathon Holdings and so forth within the tech sector.

As a result of all of these changes, we anticipate increased market volatility in the short term, which will give rise to meaningful price swings up and down.

How Will This Affect Traders?

- Swing traders will have the opportunity to profit from both bullish and bearish setups throughout the year

- Investors looking to accumulate fundamentally strong stocks such as Apple, Microsoft, McDonalds etc for the long-term, will be able to do so at a significant discount.

- Options traders can look to use options as a hedging mechanism for their portfolio or to profit from the expected increase in volatility.

2) New all-time highs for The S&P and Dow?

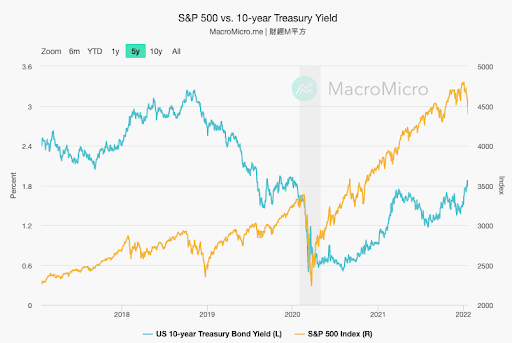

Institutions and big money managers actively invest their funds in the stock market or the bond market. Logically, they will invest any excess cash into the stock market if the stock market offers higher returns than the bond market.

As shown in the figure below, the stock market continues to give a far better return than the bond market, indicating that money will continue to flow into the stock market through 2022, especially when prices look to be at suitable discounts.

We expect more of a U-shaped recovery once the markets confirm they have bottomed. Whether the markets make new highs in 2022 will depend on the severity of this correction and speed with which it baselines and recovers. It’s probably too early to say if we make new highs in 2022 just yet.

What Is the Impact on Traders?

For short-term traders, it would be wise to be extra selective with your stock picks and not go aggressively short on a particular stock when it and the broader markets are already oversold.

At WiseTraders, we are going to focus only on setups that are exhibiting our designated Big Money Footprints. Pullbacks that then consolidate around Key Levels will be our preferred trade setup in 2022.

3) Cautiously optimistic view

The expectation of increased short-term volatility and a U-shaped recovery leads us to take a cautiously optimistic view of the markets throughout 2022. When stock participate in the upward trajectory of a U-shaped recovery, our kind of setups are easy to spot and trade.

In the meantime, it’s important that traders focus on protecting their profits early and do not allow decent profitable positions to turn into losses.

What Does This Mean for Traders?

We recommend traders to set conservative profit targets and accumulate the small wins when a position moves in their favor.

This may result in a smaller risk/reward ratio, but it will mean a higher win/loss ratio, boosting a trader’s confidence when navigating a volatile market like this one. When trading, the key is to remain disciplined and not become greedy.