Latest News

Mixed Signs of Overbought So Stick With Good Value

Greetings from the mainland of Greece! The SPY, QQQ and DIA are technically overbought while the IWM is lagging as it often does in bullish markets. This gives us interesting opportunities. That doesn’t mean the big indices can’t keep running for a while, but the chances of a pullback will increase by the day. You need to watch the signs – for example a monorail reversal bar from an overbought position is often an indication of exhaustion. If you’re sticking to our guidance to focus on Big Money Footprint stocks that are still close to their 50-day or 200-day Key Levels, then you won’t be getting suckered into overbought issues in any case. In the past week several of our setups made good progress and a number are still valid for consideration this week.

Market reviews and blogs

Your best source of investment news from WiseTraders and Guy Cohen.

The Bulls Are In Control But There’s Still Value Out There

Within hours of my write-up last week, the world changed! Energy and defence stocks were old hat, tech and finance

A Pullback Would Be Optimal

With such high stakes geopolitical uncertainty in the air, a controlled pullback would be a gift. Overall, you can see

Focusing On The Most Obvious Sectors

Friday’s escalation of events in the Middle East have got the markets guessing what next. Until then, they’d broadly still

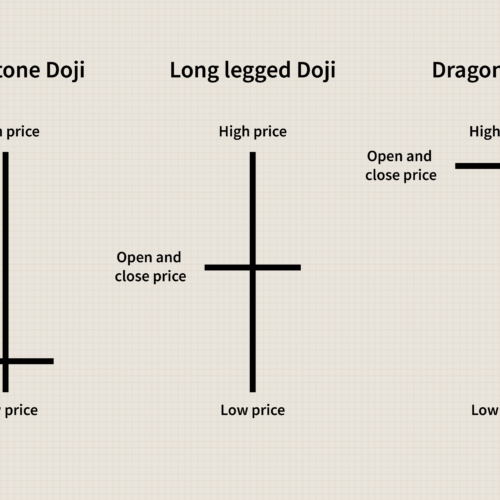

Beware the Doji

Hi Everyone

Just a quick note to say that Doji type long-tailed bars have formed on the Dow, Nasdaq, S&P and a number of leading stocks including AAPL, GS, AMZN and WYNN to name but a…

Is the Recession Really Over?!

Hi Everyone

A concerted move up yesterday throughout the board as the US “officially declares the end to the recession” – notice I put that in parenthesis!

First let me say that I don’t ha…

Charts are Bullish – OVI is shy

Hi Everyone

Ok, we have some divergence with the markets looking bullish (with nice bull flags forming) but the OVI having turned down on the S&P and the Nasdaq.

Let’s put this in context. …

GLD Update

Hi Everyone

GLD finally broke out today meaning if you were patient, you’d be in a trade right now.

It’s been a pretty dramatic breakout and the OVI never got into negative territory even…

Extra Note on GLD

Hi Everyone

I forgot to mention GLD, which is a Gold ETF …

Having been bullish for several weeks now, GLD stands on the precipice of a new breakout from its June highs.

The OVI w…

OVI Market Update 03 September 2010

Hi Everyone

Impressive work by the markets on Friday but remember, in order to trade an upswing we need one of two things present before we can activate a trade safely:

(a) A consoli…

No breakout, no losses

The Markets

One of the key advantages of trading breakouts with a robust trading plan is that if a flag or channel doesn’t break out in the direction of the trend, you won’t lose because your trade wa…

Strong bounce … for now

A strong bounce off the short term support today so far. There’s still a while to go today, but keep things in perspective, we just had the worst August in 10 years! Employment is still a …

Your OVI Market Alert, 26 August 2010

OVI has been negative for the QQQQ over the last month and isn’t fairing well either for the S&P. The Dow OVI is neutral but as I’ve said before it does tend to be more bullish than the othe…

Your OVI Market Update, 20 August 2010

Earnings season is pretty much over now, the OVI is negative on all indices, and bearish patterns are in the ascendancy.

There have been some fantastic bear flags recently that many of us have prosper…