Latest News

The Bulls Are In Control But There’s Still Value Out There

Within hours of my write-up last week, the world changed! Energy and defence stocks were old hat, tech and finance stocks were in! While that’s quite normal in times of instability reaching a conclusion, the tricky part was anticipating that it would happen literally overnight. All of which meant we didn’t get the small pullback that we were hoping for. Instead the markets kept drifting up. But if you’d picked good setups near Key Levels like AMD and CAT (and many others), then you’d still be quids in. If you haven’t done so already, make sure you never miss an alert, software update or market commentary join our free Telegram channel here. Before my Market Outlook for the week ahead, just to remind you that personalisation of our charts is on its way, so you’ll

Market reviews and blogs

Your best source of investment news from WiseTraders and Guy Cohen.

A Pullback Would Be Optimal

With such high stakes geopolitical uncertainty in the air, a controlled pullback would be a gift. Overall, you can see

Focusing On The Most Obvious Sectors

Friday’s escalation of events in the Middle East have got the markets guessing what next. Until then, they’d broadly still

Markets Hovering Rather Than Soaring

The S&P’s 200-dma did its job as we anticipated, acting as support as the markets have ground upwards. This is

Easy as 10-minutes per day

Hi EveryoneYOU CAN MAKE THIS VERY EASY – STICK TO THE OVI AND SUPPORT/RESISTANCE BREAKOUTSWhen you see the charts in this eLetter you’re going to like how easy our trading method is.Remember, we trad…

Don’t Force It …

Hi Everyone

The markets are wobbly right now and it could be a case of “Sell in May and Go Away”. The key to your trading success is don’t force a trade when it’s simply not there…

No Breakout No Losses

Hi Everyone Commodities and commodity stocks have continued to slide, especially Silver after its parabolic run, and the main indices are consolidating. Many stocks forming Bull Flags have rolle…

OVI Market Update

Some wobbles in the markets over the last couple of days with Silver in particular taking a pounding, Gold and Oil looking vulnerable too. World events don’t seem to have had much effect as we look …

OVI Update

Well, this earnings season has something for everyone as the indices grind upwards but some leading stocks have been hammered, some have whipsawed, and others have missed targets and yet still hav…

OVI Update

A quick update on yesteday’s post. The tech sector has sent the markets soaring. This, mixed with Standard & Poors downgrading “Uncle Sam” has also led to Gold and Silver continuing …

Informed Trader eLetter – OVI Report

Hi Everyone

Mixed news is the how this earnings will be remembered. Some stocks have been flying and others have been hammered! Let’s start with the main indices: SPY (S&P…

In the thick of Earnings Season – see AAPL

So last week we had GOOG causing shockwaves. This week it could be AAPL’s turn on the 20th. Now this is one I have mixed feelings about … here’s why: You’d be a brave soul to eve…

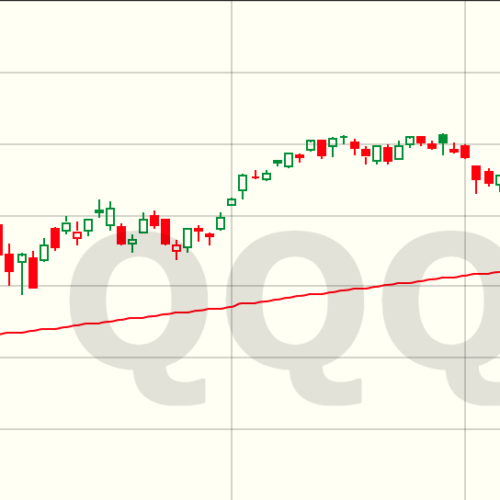

OVI Charts – QQQQ is now QQQ

A quick note to alert you that the QQQQ has gone back to its original symbol of QQQ. Normally that wouldn’t be an issue, but the new symbol needs to be annexed to the old symbol within our OVI c…

No Surprises Whatsoever

Hi Everyone.

As horrific as the events in Japan have been, make no mistake, the markets were going to fall anyway.

The OVI on the S&P and Nasdaq has been pointing the way for almost …