Latest News

The Bulls Are In Control But There’s Still Value Out There

Within hours of my write-up last week, the world changed! Energy and defence stocks were old hat, tech and finance stocks were in! While that’s quite normal in times of instability reaching a conclusion, the tricky part was anticipating that it would happen literally overnight. All of which meant we didn’t get the small pullback that we were hoping for. Instead the markets kept drifting up. But if you’d picked good setups near Key Levels like AMD and CAT (and many others), then you’d still be quids in. If you haven’t done so already, make sure you never miss an alert, software update or market commentary join our free Telegram channel here. Before my Market Outlook for the week ahead, just to remind you that personalisation of our charts is on its way, so you’ll

Market reviews and blogs

Your best source of investment news from WiseTraders and Guy Cohen.

A Pullback Would Be Optimal

With such high stakes geopolitical uncertainty in the air, a controlled pullback would be a gift. Overall, you can see

Focusing On The Most Obvious Sectors

Friday’s escalation of events in the Middle East have got the markets guessing what next. Until then, they’d broadly still

Markets Hovering Rather Than Soaring

The S&P’s 200-dma did its job as we anticipated, acting as support as the markets have ground upwards. This is

We Did It!!

Hi Everyone A huge thank you! Just hours after our webinar we’re #1 on Amazon’s Bestseller list for Stocks. Here’s the screenshot … I’ll send the recording for the webinar late…

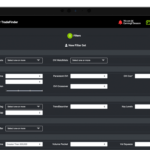

Intelligent Filtering With FlagTrader

Hi Everyone A quick tip on how to use our filters intelligently in FlagTrader. * Let’s say you start your routine with the OVI Traders Club Express40 stocks. * You see that CVX and SLB bot…

Interesting Stocks Today

Hi Everyone Your regular routine should only take a few minutes. Once in a while you may want a more thorough look at the market, but essentially it should be as follows: 1. Check the OVI E…

OVI Market Commentary

Hi Everyone The main idices are still grinding up on low volume as we draw to the end of earnings season. The S&P has a marginally positive OVI while the Nasdaq’s is neutral. It’s almo…

AAPL and GS Breakout with Dojis

Hi Everyone The market creeps up but it’s still a bit ugly out there. Both AAPL and GS have broken out as expected but are both now forming Doji bars. The AAPL one is obvious, but…

Ugly Markets and Earnings

Hi Everyone As we draw to the close of earnings season, make no mistake, it’s been ugly out there folks! The main indices have been grinding upwards but on low volume and with rough and volati…

A Classic Reversal Setup

I just had to show you a classic reversal setup that I saw last night. SPYIn the chart you can see a Doji bar setup where there is also a 20-day extreme in price. Here it’s a price high,…

The Market is on Vacation

Well, sometimes you just have to allow the market to have rest. Right now we’re seeing a lot of churning and many stocks exhibiting neutral or nondescript OVI readings. That’s fine … the…

Lunch with a Trading Legend

On my travels in the US, and yesterday I was privileged to have lunch with a trading legend. Gil Morales is a former colleage of the great William O’Neil, and co-wrote the phenomal book “How to …

You Must Take Partial Profits at the P1 Profit Target

Hi Everyone A couple of months ago I was privileged to meet two people who have made an phenomenal success from trading with my methods. By this I mean they had multiplied their account TEN-fold…