Latest News

The Bulls Are In Control But There’s Still Value Out There

Within hours of my write-up last week, the world changed! Energy and defence stocks were old hat, tech and finance stocks were in! While that’s quite normal in times of instability reaching a conclusion, the tricky part was anticipating that it would happen literally overnight. All of which meant we didn’t get the small pullback that we were hoping for. Instead the markets kept drifting up. But if you’d picked good setups near Key Levels like AMD and CAT (and many others), then you’d still be quids in. If you haven’t done so already, make sure you never miss an alert, software update or market commentary join our free Telegram channel here. Before my Market Outlook for the week ahead, just to remind you that personalisation of our charts is on its way, so you’ll

Market reviews and blogs

Your best source of investment news from WiseTraders and Guy Cohen.

A Pullback Would Be Optimal

With such high stakes geopolitical uncertainty in the air, a controlled pullback would be a gift. Overall, you can see

Focusing On The Most Obvious Sectors

Friday’s escalation of events in the Middle East have got the markets guessing what next. Until then, they’d broadly still

Markets Hovering Rather Than Soaring

The S&P’s 200-dma did its job as we anticipated, acting as support as the markets have ground upwards. This is

A Very Important Chart Pattern

Important Chart Pattern – Railroad Tracks in the Country

On Monday both AAPL and AMZN formed the identical chart pattern, but AAPL was going in one direction and AMZN was going in the other. &nb…

OVI Market Commentary

OVI Market Round Up This is an email with lots of charts, something we will be doing more of very soon. Ok, first for the indices. Starting with the DIA (DOW ETF) which we d…

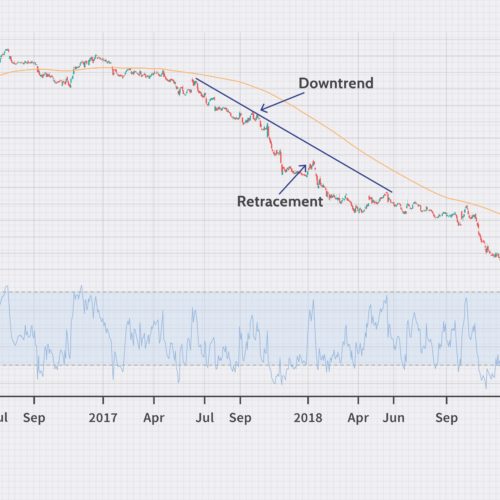

OVI Highlights – VIX at 5-Year Low

VIX at 5-Year LowThe VIX (Chicago Board Options Exchange Market Volatility Index) is a measure of the implied volatility of the S&P 500 index options. It represents one measure of the m…

OVI Highlights – Markets Behaving, And Earnings Around Corner

OVI HighlightsEarnings is almost upon us, so new positions must be taken with care. We’ve had a great run with many stocks – particularly the financials – and at some point they’ll need to r…

OVI Alert – Review of the Past Few Weeks

OVI-Flag HighlightsIn mid-late December I mentioned a number of stocks that looked poised for breakouts to the upside. Of course we’ve had fiscal cliff dramatics to deal with along the way, b…

New Year Knife-Edge

The markets are completely on a knife-edge as illustrated by many bull-flag patterns that are behaving indecisively and OVIs that are hovering near their neutral lines.

The message is a …

Fiscal Cliff Drama Creating Volatility

As you can see from today’s wild action, the fiscal cliff drama is creating serious volatility in the markets with the indices closing near their highs for the day having plummeted earlier, before th…

Markets Poised Like a Coil on a Spring …

They may not be quite ready yet, but there is a growing sense that the markets are coiling on a spring and will be on the move soon … I would say by the end of the year we should have a clear signal…

Google, GS, Earnings Season and a Short Video

Google, GS, Earnings and Why My Students SucceedMy trading plan gives you both safety and the ability to make windfalls. The plan has been honed after years of experience and research. &nbs…

Last Night’s Webinar

Hi Everyone Last night’s webinar recording is now available here. In it we did a thorough overview of the OVI-Flag combo strategy, we analyzed a number of stocks including KORS,…