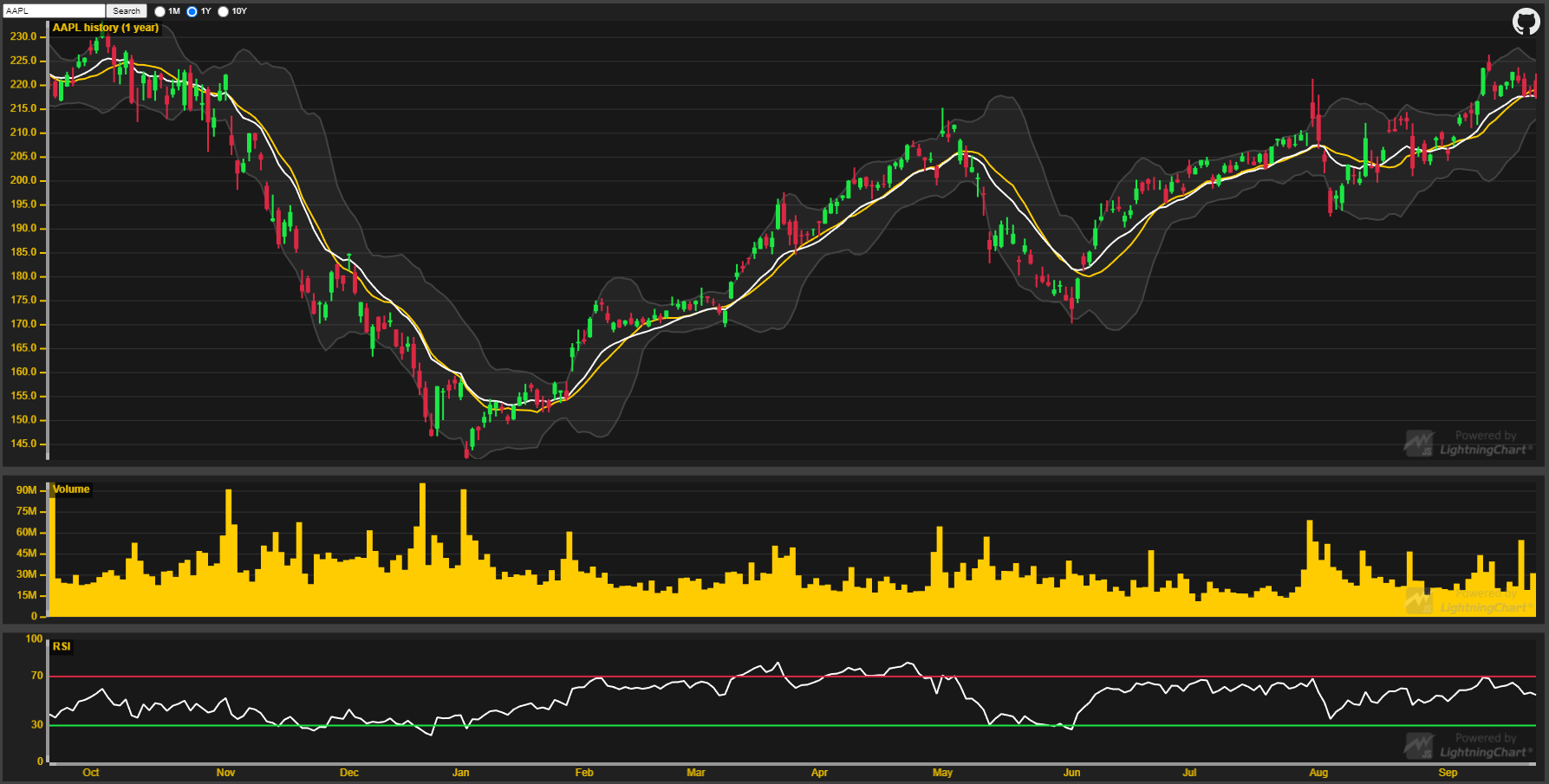

Bullish End to Holiday Season

The holidays are almost over and from a pure charts and OVI perspective the market looks strong. As you’ll see from today’s video many stocks are setting up in clusters and you’ll notice how flui…

Stock trading courses and applications to shape you into a more 'informed' and confident trader.

Perfect for all levels of experience.

Discover the power of trading with responsible leverage through our options courses and applications.

Perfect for intermediate or advanced traders.

Receive tailored, one-to-one coaching and guidance from a professional trading mentor.

Perfect for all levels of experience.

Supercharge your stocks or options trading journey at one of our live events.

Perfect for all levels of experience.

Stock trading courses and applications to shape you into a more 'informed' and confident trader.

Perfect for all levels of experience.

Discover the power of trading with responsible leverage through our options courses and applications.

Perfect for intermediate or advanced traders.

Receive tailored, one-to-one coaching and guidance from a professional trading mentor.

Perfect for all levels of experience.

Supercharge your stocks or options trading journey at one of our live events.

Perfect for all levels of experience.

The holidays are almost over and from a pure charts and OVI perspective the market looks strong. As you’ll see from today’s video many stocks are setting up in clusters and you’ll notice how flui…

As I mentioned last week the markets have continued their solid recovery since the railroad track reversal pattern on 7-8 August, with the low volumes most likely to be attributable to the time of yea…

The markets have continued their solid recovery from the recent correction, but on low volume. This isn’t necessarily something to be suspicious of because we’re in the middle of holiday season …

Friday’s action exhibited potential reversal behaviour while the OVI for the main three indices remained negative. The green hollow price bar means potential respite for the markets, but the con…

A short video today comparing this current retracement with previous ones over the past year. The previous ones have tended to resolve themselves with clear reversal signals occurring in the S&a…

Yesterday’s volume was low as the indices recovered some of their poise. The low volume is not the behaviour of hungry bargain hunting bulls, so we’re not out of these woods yet. Not all s…

Last Monday (28th July) I gave a clear warning that the markets looked fragile and that this was a time to be cautious. I know many seasoned OVI traders took heed and tightened their stops, noti…

Lots going on in the world and yet the market has continued to demonstrate its resilience as shown by price action and OVI behaviour. This is one of the reasons I don’t pay too much attention to…

I’ve mentioned several times recently about the importance of protecting your gains, and this has been particularly important as the market wobbles in the run up to this earnings season. I don’t …

Last week I repeated the suggestion that you should ‘Hold onto your gains’. With yesterday’s pullback those words are looking prophetic, especially as we move into earnings season. However…