A time to be in cash

As I mentioned in my members’ meeting last Thursday, this is what you’d call an ideal time to not trade. We’re still in the thick of earnings, though many of the large market movers have already…

Stock trading courses and applications to shape you into a more 'informed' and confident trader.

Perfect for all levels of experience.

Discover the power of trading with responsible leverage through our options courses and applications.

Perfect for intermediate or advanced traders.

Receive tailored, one-to-one coaching and guidance from a professional trading mentor.

Perfect for all levels of experience.

Supercharge your stocks or options trading journey at one of our live events.

Perfect for all levels of experience.

Stock trading courses and applications to shape you into a more 'informed' and confident trader.

Perfect for all levels of experience.

Discover the power of trading with responsible leverage through our options courses and applications.

Perfect for intermediate or advanced traders.

Receive tailored, one-to-one coaching and guidance from a professional trading mentor.

Perfect for all levels of experience.

Supercharge your stocks or options trading journey at one of our live events.

Perfect for all levels of experience.

As I mentioned in my members’ meeting last Thursday, this is what you’d call an ideal time to not trade. We’re still in the thick of earnings, though many of the large market movers have already…

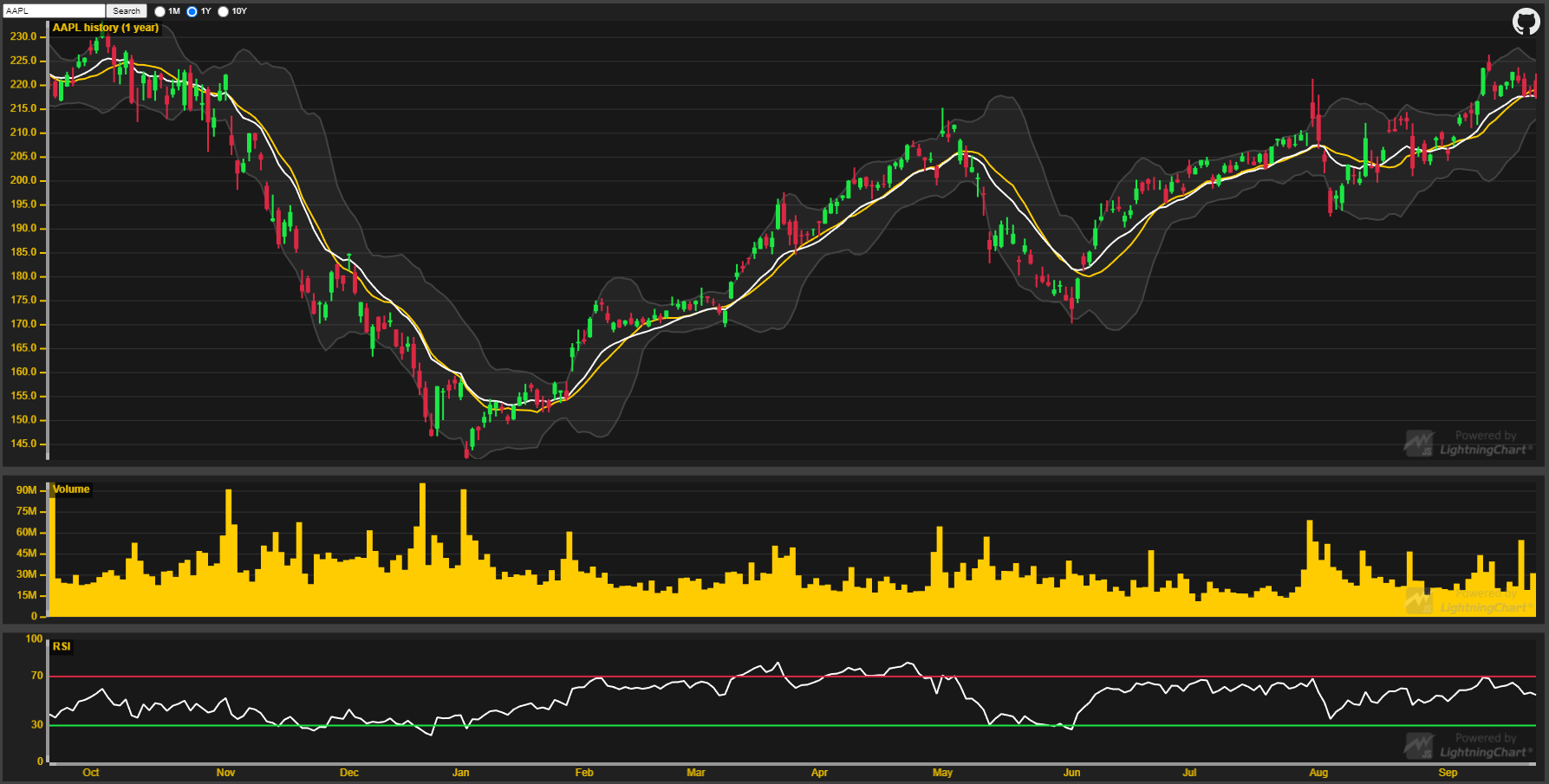

A big day today as the market awaits AAPL’s earnings announcement, and there are more to follow later in the week. Be sure to notice our earnings tool that not only tells you the date of a stock…

It’s been a mixed bag out there for this earnings season, with the financial stocks dropping, bouncing and stalling, and several majors about to announce this week. SBUX and NFLX …

After a hesitant start the Railroad Track I identified on Monday certainly found its sweet spot yesterday with a powerful surge of 31 points on the S&P, 260 on the Dow, and closing near the day’s …

As I mentioned the other day the SPY and DIA exhibited railroad tracks albeit not the most compelling. The reaction has been a tentative reversal that at least i…

The SPY and DIA are exhibiting railroad tracks (not the most compelling but the pattern is there), and a couple of select stocks are showing signs of promise. Otherwise, we’re still in the thick…

So the railroad track reversal from last week was profitable but very short term. And as suggested in the video, during times like these you need to think about protecting those one-day profits …

Again our unique approach to reversals are proving most lucrative, with a stunning turnaround from the Dow and S&P Index railroad track ‘esque patterns that I highlighted yesterday. Here is …

I mentioned yesterday that reversals would be a better bet to focus on for now. The Dow-30 and S&P indices did form vague railroad track ‘esque setups, but their corresponding ETFs (the DIA …

As I mentioned yesterday this downdraft is likely being fuelled by three factors: – First is the uncertainty relating to the price of oil. I guess you can throw into the bargain various Eur…