A Costly Snooze

So after two dozen great one-day reversals during September and October, the big one – the one that really mattered – was the one that I also identified correctly as another reversal, but decided to s…

Stock trading courses and applications to shape you into a more 'informed' and confident trader.

Perfect for all levels of experience.

Discover the power of trading with responsible leverage through our options courses and applications.

Perfect for intermediate or advanced traders.

Receive tailored, one-to-one coaching and guidance from a professional trading mentor.

Perfect for all levels of experience.

Supercharge your stocks or options trading journey at one of our live events.

Perfect for all levels of experience.

Stock trading courses and applications to shape you into a more 'informed' and confident trader.

Perfect for all levels of experience.

Discover the power of trading with responsible leverage through our options courses and applications.

Perfect for intermediate or advanced traders.

Receive tailored, one-to-one coaching and guidance from a professional trading mentor.

Perfect for all levels of experience.

Supercharge your stocks or options trading journey at one of our live events.

Perfect for all levels of experience.

So after two dozen great one-day reversals during September and October, the big one – the one that really mattered – was the one that I also identified correctly as another reversal, but decided to s…

The post-earnings gap-up and consolidation is a worthy chart setup. With a persistently positive OVI it is excellent. During the last year fine examples have included AAPL (April/May), FB …

The market continued its impressive snapback last week, and as we emerge from earnings we’ll have a better idea where it wants to go. As ever this earnings has witnessed its winners and losers, …

A significant snapback in the markets over the last few days, but there are still plenty of stocks yet to report earnings and the market remains volatile. Many stocks’ OVI readings are still neg…

We’re well into earnings now and there’s no let up in the volatile nature of these markets. As expected – and mentioned in last Thursday’s webinar and recording – we did see a reversal on Friday…

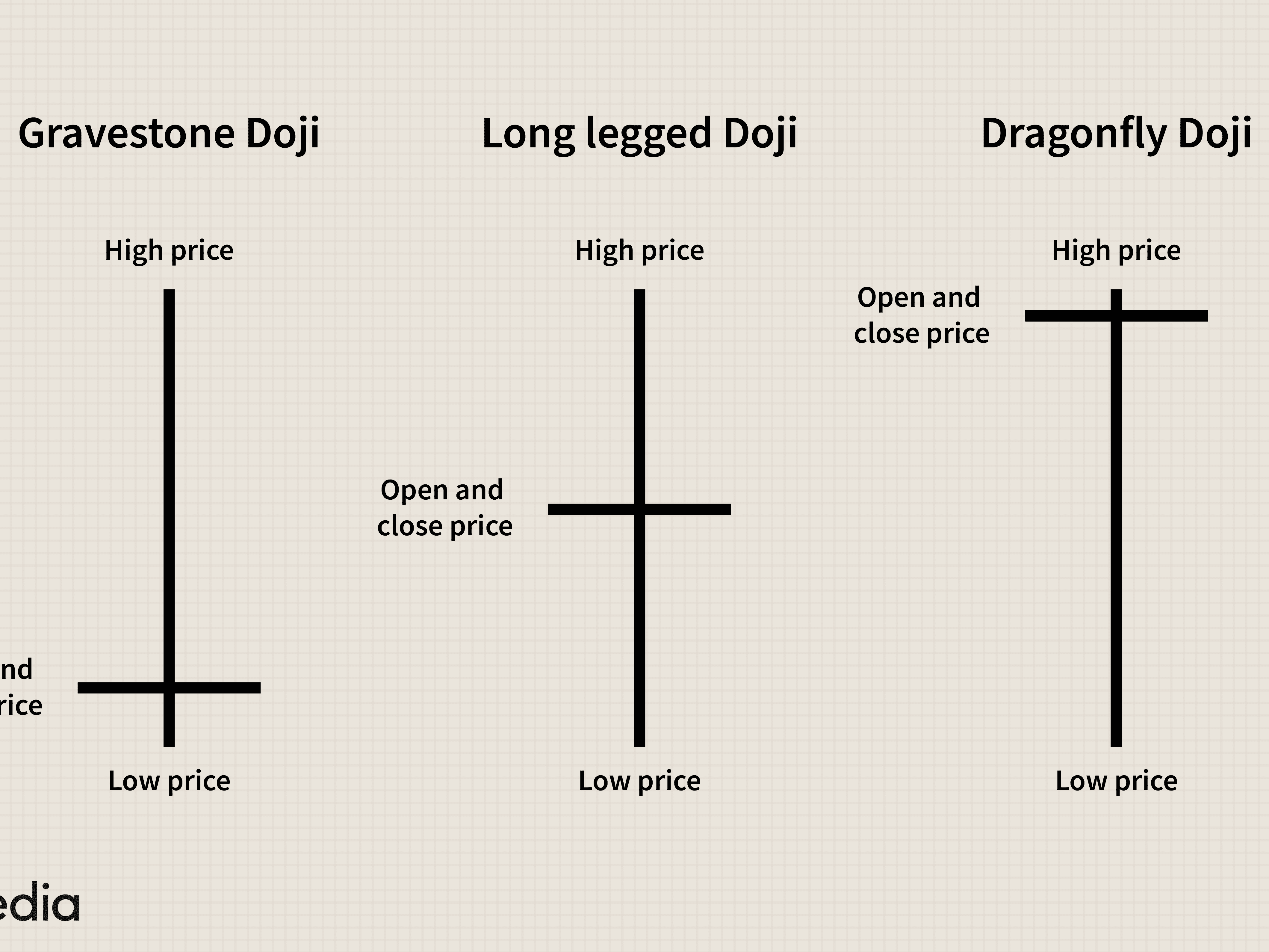

There are plenty of Doji reversal setups today after a wild day in the markets yesterday. However, we’re now in the thick of earnings season and with the markets as they are, do you really need …

As mentioned on Friday morning the three main indices all formed prominent Doji reversal bars and did indeed reverse on Friday before running out of steam somewhat yesterday. I also mentioned th…

The three main indices all formed prominent Doji reversal bars yesterday, but I didn’t find a huge number of worthy Doji stocks too. As predicted several weeks ago the markets have been rather vo…

A short video today comparing this current retracement with previous ones over the past year. The previous ones have tended to resolve themselves with clear reversal signals occurring in the S&a…

Yesterday’s volume was low as the indices recovered some of their poise. The low volume is not the behaviour of hungry bargain hunting bulls, so we’re not out of these woods yet. Not all s…

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.