Frequently Asked Questions

Answers to top questions about WiseTraders software, trading education and membership packages.

About Our Services

What is the OVI?

The OVI (Options Volatility Indicator) is our proprietary patented indicator that is derived from options transaction data. We use it to analyze stocks where there is evidence of large leveraged position-building. You can use the OVI to trade stocks, ETFs and options.

How much experience do I need to use a WiseTraders stocks or options membership?

What is included in a WiseTraders membership?

We offer five membership options tailored to your trading needs and style:

- Stocks Essentials: Ideal for those focused on Stock Selection, it includes access to our FlagTrader software for automating the ‘Big Money’ strategy.

- Stocks VIP: The comprehensive choice, covering Market Timing, Stock Selection and Trade Plan. It includes the Market Timing Toolkit, VIP Stocks Software and our latest stocks training.

- Options Essentials: Ideal for beginners and traders graduating from Stocks to Options. Includes access to the OptionEasy ‘4XL’ TradeFinder to automate finding ‘Smart Leverage’ trade ideas in just seconds.

- Options VIP: Our ultimate Options membership with all three Master Keys covered. It includes the Market Timing Toolkit, VIP Options Software, Complete OptionEasy suite and latest options training. Suitable for new Options traders and those looking to exploit market volatility and/or income strategies.

- Platinum VIP: A great option for traders looking to unlock our entire software and training suite. Typically our long-standing members opt for this membership due to the ease of managing one subscription.

- Our Patented OVI Indicator

- Our Premium Stock Charts

- A Personalised Digital Trading Journal

For those seeking to fast-track their progress, we also offer one-to-one Mentoring.

If you need any help choosing the membership that best suits your trading goals and style, please feel free to book in a call with our team here.

How do I learn to use the software included in the memberships?

Our software is intuitive, and our help menus are embedded locally in each section of each application. No manuals required!

What do you cover in the Stocks and Options events?

Both events are focused on our specific strategies and practical implementation of our trade plans.

The WiseTraders Summit covers our four OVI setups plus an extra one on top. Stocks conforming to any of the setups can be easily found in a single click via the accompanying VIP TradeFinder.

The OptionEasy Bootcamp covers all the main options strategies that work alongside OVI setups. The accompanying TradeFinder application means you can find stocks conforming to our OVI and options criteria in click.

I’m new to all of this. Would a Mentorship be the best solution?

It really depends on how much personal attention you prefer, which is a personal choice. Our mentorships focus on ensuring you stick to our plans for the best outcomes. This means developing a rock solid routine and making it super efficient so you enjoy it and keep to it.

Of course the mentorships also reinforce all the knowledge from our courseware as well as ensuring the practical application of our methods.

How much time do I need to spend trading every day?

Really not much. We don’t sit there staring at our screens as we focus on end-of-day prices. Many of our most successful members are only doing a couple of trades per week on average. Sometimes this will mean several trades one week and then none for a while depending on market conditions.

Of course there are other members who like to be more active, and that’s fine too, provided you stick to our setups and trade plans.

How much does it cost?

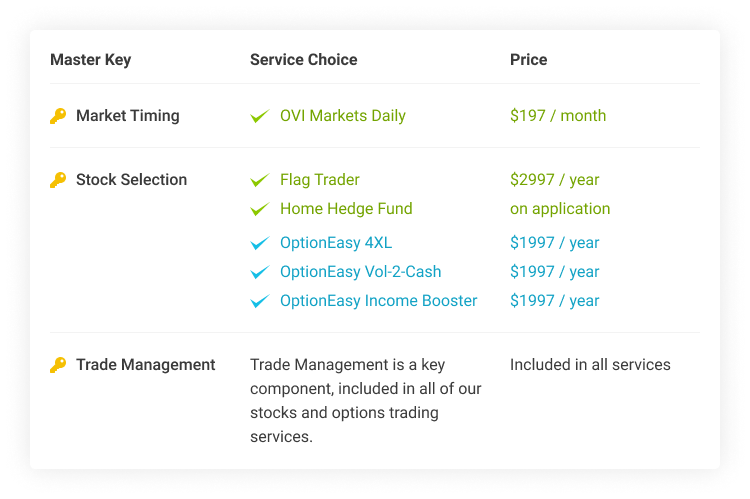

The cost depends on which service you subscribe to. The optimal combination is to include all three Master Keys:

- Market timing

- Stock selection

- Trade management

The optimal entry package is to combine OVI Markets Daily with FlagTrader.

What is Market Timing?

Analyzing market conditions means we can focus our trading activities during the most friendly market conditions. Think of crossing a passage of water during smooth conditions vs. choppy conditions. We prefer smooth waters!

What are the ‘Big Money Footprints’?

The “Big Money Footprints” form the main part of our stock selection criteria. “Big Money” alludes to the activities of larger professional market participants. These players leave footprints of their big money activity in a stock and its options. The key here is the impact on supply and demand which then affects prices moving forward. When big money is in evidence the probability of a move is enhanced.

What is the EDGE trading plan?

Even with probabilities in our favor, we still need a trading plan in order to control risk and protect our profits to the optimal degree.

The EDGE (Enter, Defend, Grow, Evidenced) trading plan ensures we protect our trades by only considering the right setups, protecting our capital through sensible entries and initial stops, and protecting and optimizing our profits.

Our trading plan:

E – Enter every trade with complete control

D – Defend (or protect) profitable positions early

G – Grow your account

E – Evidenced (trade using an evidenced, logical system)

Our Software Solutions and Technology

What markets are covered by WiseTraders software?

US stocks, options, and ETFs.

Where can I access the OVI indicator?

Because the OVI is a proprietary indicator, it is only available to our clients and members.

Unlike other technical indicators (MACD, EMA, Bollinger bands etc) that are universally available on any charting system, THE ONLY way to access the OVI is through a subscription to our stocks and options memberships.

Who can access the OVI tools and software?

How does the OVI work?

Can the OVI be used to trade other financial instruments like Forex, Bitcoin, Bonds etc?

Yes, the OVI can be used to trade these other financial instruments if they have optionable ETFs.

Can the OVI be used for intraday trading?

You can use the OVI’s end-of-day readings to enhance your intraday trading, but we don’t tend to focus on intraday trading in our learning materials.

Does WiseTraders software integrate with placing trades on brokers’ platforms?

Not yet, but our vision is to provide a broker solution in time.

Do you have a list of recommended brokers for new traders?

Our Support team (support@wisetraders.com) provide a list of brokers who can implement the types of trades we advocate, but we are generally broker agnostic.

Do you offer stock picking services?

We do not offer specific trading advice. We do offer idea generating services where our criteria are focused, proprietary and researched.

Is there a minimum required account size to start trading with the OVI system?

It depends what type of trading account you have.

For traditional stocks and options trading accounts we’d say a minimum of $3,000 though we do know of some who started lower and have achieved success.

If you’re outside the US and doing spread-betting or CFDs you can start with literally just a few hundred dollars.

What is FlagTrader?

FlagTrader is our flagship stock-selection filtering software. It uses our Big Money Footprints filters including the OVI to identify stocks setting up just the way we like them to. You can find qualifying stocks in literally one click! FlagTrader is included within our Stocks memberships.

What is covered in the OVI Markets Daily?

OVI Markets Daily covers the market timing aspect of our three Master Keys of trading. The service includes short and long term market timing indicators, as well as providing a unique view of the markets and a number of excellent tools for identifying stocks and developing your skills.

OVI Markets Daily is included within our Stocks VIP and Options VIP memberships.

Why is Home Hedge Fund best for seasoned traders who are already FlagTrader members?

Home Hedge Fund provides trade ideas resulting from various criteria that have emerged from our practical experience and quantitative research. You need to be a Platinum VIP member in order to qualify for the Home Hedge Fund service.

What do I get with the OptionEasy suite?

The entire OptionEasy suite contains the following three main modules:

- 4XL – for simple leverage using the Big Money Footprints and specific options criteria.

- Vol-2-Cash – for exploiting an increase in volatility while being direction-neutral, using our proprietary filters and methodology.

- Income Booster – for nine popular income strategies, including:

covered call; diagonal call; calendar call; naked put; collar; bull put; bear call; iron butterfly; iron condor.

All these main modules include the OptionEasy Premium Education module (also available separately) and a suite of other tools including options calculators, etc.

Memberships and Customer Support

What if I want to speak to someone before subscribing to a membership?

Just contact us at support@wisetraders.com and we’ll arrange a call back. We’ll make sure you have the right information in order to make a decision.

Do you offer a monthly or yearly payment plan for all of your services bundled together?

Yes, an increasing number of members are requesting this. Please contact support@wisetraders.com with the heading “Platinum VIP Enquiry” and we’ll arrange a call ensure you get the right package for you.

Can I cancel my membership at any time?

With a monthly membership you can cancel with 14 days notice.

With an annual membership, you have a 30-day money back guarantee. Simply contact us within 30 days of your purchase and we’ll give you a full refund.

Email us at support@wisetraders.com if you would like to cancel your membership or request a refund.

What sort of questions does the Support team help with?

Our Support team (support@wisetraders.com) can help with anything from tech queries to trading queries involving our methods and software.

Please note that WiseTraders does NOT provide any financial or specific investment / trading advice via any of our software, communications or coaching services. If you seek specific guidance, please seek advice from a registered advisor or your broker.

Account Access

What are the system requirements to view the OVI charts?

We recommend you use Firefox/Chrome/Edge for better chart performance. Older operating systems on mobile/tablet/PC may not be able to view the OVI charts.

Can I access the Stocks and Options software from a mobile device?

Yes, our applications are already fully optimised for tablet/iPad devices. We’re also working towards making them mobile phone friendly.

What should I do if I am unable to view the OVI charts/watchlists/software?

As a first thing, try clearing your browser cache.

We offer tips on how to address possible account access issues in our Members Login area.

If you still have problems, please email support@wisetraders.com for further help.

Still have a question?

If you cannot find an answer to your question in our FAQ, you can always contact us directly.

We will answer you shortly!