How Retail Traders Can Navigate Stock Splits Safely

We’re all familiar with Google’s stellar business performance and how it has resulted in a skyrocketing stock price for its parent company, Alphabet.

As things stand, we’re now looking at a stock price near $3,000 per share – the thing is..it’s about to get a lot cheaper. This month the tech giant announced its intention to split its stock. Is this a positive or negative development for private investors? Let’s examine how a stock split works and what it means for retail trading.

What is a Stock Split?

A stock split occurs when a company increases the number of shares issued to current shareholders. The number of outstanding shares increases and the price per share decreases proportionately while the market capitalization and value of the company does not change.

For example, a 2-for-1 stock split will double the company’s total outstanding shares and halve their share price.

The table below illustrates the impact of a 2-for-1 stock split on the company’s outstanding shares and share price.

Number of Outstanding Shares | Price per share | |

Before the 2-for-1 stock split | 10 million | $500/share |

After the 2-for-1 stock split | 20 million | $250/share |

Several megacap tech stocks such as Apple (AAPL), Tesla (TSLA) and Nvidia (NVDA) have undertaken stock splits since 2020.

Google parent Alphabet Inc. (GOOGL) announced a 20-for-1 stock split on 1 Feb, 2022. In other words, for every share that an investor has, there will now be twenty.

The split, the first time in eight years, will occur on 1 July, 2022 and the stock will begin trading under its split-adjusted price on Monday, 18 July.

Why do Companies Split their Stocks?

Companies tend to split their shares when their stock price becomes too high. Splitting their stock makes the company’s shares more accessible to retail investors and traders. This can also help increase the stock’s liquidity.

In the case of GOOGL, it’s current share price is $2,787.98 (based on 8 Feb price). The 20-for-1 stock split will result in a new price of $139.40 per share which is much more affordable to retail traders. Existing shareholders will be given 19 additional shares for each share of GOOGL they own prior to the split.

Impact of Stock Splits on Traders

Option Contracts

Traders who own in-the-money or at-the-money options on a stock prior to its stock split will not end up holding “out-of-the-money” options after the split. For example, if a trader holds a GOOGL call option with a strike price of $2,800, their contract’s size will automatically be adjusted to reflect the stock split once it occurs.

In other words, the call option’s strike will be reduced from $2,800 to $140 after the split. The underlying shares of the call option will then increase from 100 to 2,000. The cost basis for the trader remains unchanged because they will still be required to pay $280,000 if they choose to exercise their call option.

Call Strike Price | Underlying Shares of the Call Option | Cost Basis if the Call Option is Exercised | |

Before the 20-for-1 stock split | $2,800 | 100 shares per contract | $280,000 |

After the 20-for-1 stock split | $140 | 2,000 shares per contract | $280,000 |

Stop Orders

Stop orders are generally used to get traders out of a position if the price goes above or below a given level. Most traders use a stop-loss order to protect against significant losses, especially if they are unable to monitor their open positions regularly.

Some brokers may adjust the trigger price for stop orders following a stock split. However, we recommend traders monitor their stop orders and place a new one if necessary as most stop orders get cancelled following the split.

Short Sellers

Short sellers have a bearish outlook on a stock price. They profit when the stock price declines significantly. On the surface, a stock split might seem like a great event for short-sellers since the stock price will be reduced significantly. Many traders fall into this trap by shorting a stock prior to its split.

In reality, brokers will adjust the short-sellers’ order to account for the split. In the event of GOOGL’s 20-for-1 stock split, short sellers will owe twenty as many of the lower-priced shares! The stock split will not affect a short seller’s position and unfortunate traders who fall into this trap stand to lose more than they can gain after the split.

Trading Companies Undergoing a Stock Split

Stock splits have historically resulted in an increase in the company’s share price after the split even though the company’s fundamental value has not changed. Following this, many traders tend to chase splits due to the “fear of missing out” (FOMO).

Forget FOMO – TWYS instead!

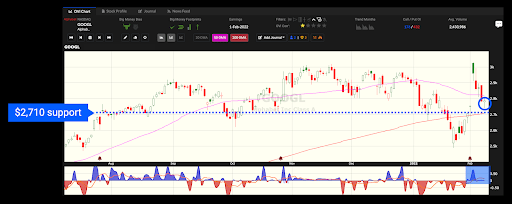

At WiseTraders, we follow the adage of “Trade What You See” (TWYS). Our Head Mentor, Glenn Sirott emphasises this constantly in our Mentorship program. To illustrate what this adage means, take a look at the OVI chart for GOOGL on 8 Feb. It indicates a slight improvement in bullish big money activity (persistently blue OVI) on this stock following its earnings report and stock split announcement on 1 Feb. The general “Big Money” bias is currently bullish on the stock.

From a WiseTraders perspective, GOOGL does not qualify as a ‘Triple A’ tradeable setup albeit having a bullish bias on the stock. This is because it has not consolidated following the massive gap up after its earnings report.

It is currently forming a doji above its 200-day moving average which could infer a potential trend reversal trade. However, this does not qualify as a great trend reversal setup because the doji has not formed around a previous support level, ie. the 200-day moving average or the stock’s historical support level at $2,710. We also prefer to see more evidence of bullish big money activity (blue OVI) on a stock chart.

Our preferred trade setup on this stock would be a consolidation with a persistently blue OVI reading. Consolidations give us a clear entry and stop loss level to place our orders. We would therefore recommend that traders watch the price movement on GOOGL first before buying into it prior to its stock split.

Remember – it is not our thoughts about a stock that move it. It is “Big Money” – the multi-billion dollar hedge funds, banks, and other leveraged institutional investors who create huge positions that ultimately cause movement.

Don’t try to ‘out-smart’ the market. Our job is to watch how “Big Money” reacts to news and events (Earnings, Splits, etc). Allow the action on the chart to reveal the behaviour of these players through the Big Money Footprints and then go for the best trade setups according to our Trade Plans – TWYS.