As Head Mentor at WiseTraders, I am often asked by my students “How can I achieve consistent trading success when the markets are in chaos?” …

Choppy price action, conflicting news headlines and continuously changing social media trends can make volatile markets feel like a bad rollercoaster ride.

And these conditions lead many traders to make knee-jerk decisions in an attempt to establish some level of control.

Just think back to your own trading …

Have you ever entered a trade you shouldn’t have because you saw a news article or opinion piece on your morning commute? Or perhaps you adjusted your trade parameters out of fear?

Don’t worry, we’ve all been there at one time or another!

The good news is that there is a simple and effective way of eliminating the overwhelming noise that accompanies volatile markets …

And you can apply it regardless of your account size or experience level …

TWYS - Trade What You See

Trade What You See (TWYS) is an approach we focus on at WiseTraders, and when followed consistently can make a BIG difference to your success.

The 60 million dollar question is … What is it that you’re supposed to be seeing?!

We’ll come to that in a moment.

Of course we all like to read headlines and try to predict what effect they might have on the market, but I have yet to meet a trader who can do this consistently.

Here’s the secret of what you should be focused on “seeing” in our interpretation of TWYS …

Price movement is based on the battle between buyers vs sellers, and their effect on supply and demand. There are ways to analyze this activity, which will have a measurable impact on probability of trading success.

At WiseTraders we focus on “Big Money Footprints” where we can detect pricing anomalies and large scale activity in stocks and options volumes.

These Big Money Footprints (or Smart Money Footprints) are effectively probability enhancers.

By focusing on these markers there is the added bonus that we are able to ignore the drama and noisy headline in the forums and financial media.

Our TWYS is focusing on the Big Money Footprints, period.

- Volume acceleration

- Price acceleration

- Breach of Key Levels

- Signals from our Options Volatility Indicator (OVI)

- Shrinking retracements

- Strategically positioned price consolidations

We won’t go into each Footprint in this article, but what you will notice is one factor that is distinctly missing …

Opinion.

Opinion from the financial press, tipsters or gossip forums.

Of course it is perfectly fine to stay current on world, local and financial news, but just don’t trade based on those headlines.

Remember, it’s Big Money activity that moves stock prices and the market, not your interpretation of daily headlines.

One aspect of Big Money activity that is also pivotal to your success is if you are also able to take advantage of “Scarce Information“.

Scarce Information is, by its very own wording … scarce! It’s what the larger players rely on, using their superior resources for R&D and connections. And they will often act with scale on that scarce information.

At WiseTraders, our Scarce Information is the ability to pick up on the most aggressive position-building activity by those large players.

Guy Cohen’s patented OVI uniquely reveals how this works by way of deep options data analysis. When combined with other Big Money Footprints, a palpable edge is achievable.

Why You Must Only Trade What You SEE, And Not What You Hear

From March 2020 to very recently, the Covid headlines dominated our daily news, fear was through the roof and it was easy to focus on that intense negativity but the market continued to go higher in a very strong way!

Doomsdayers who were caught up in the news headlines missed the unprecedented bull market.

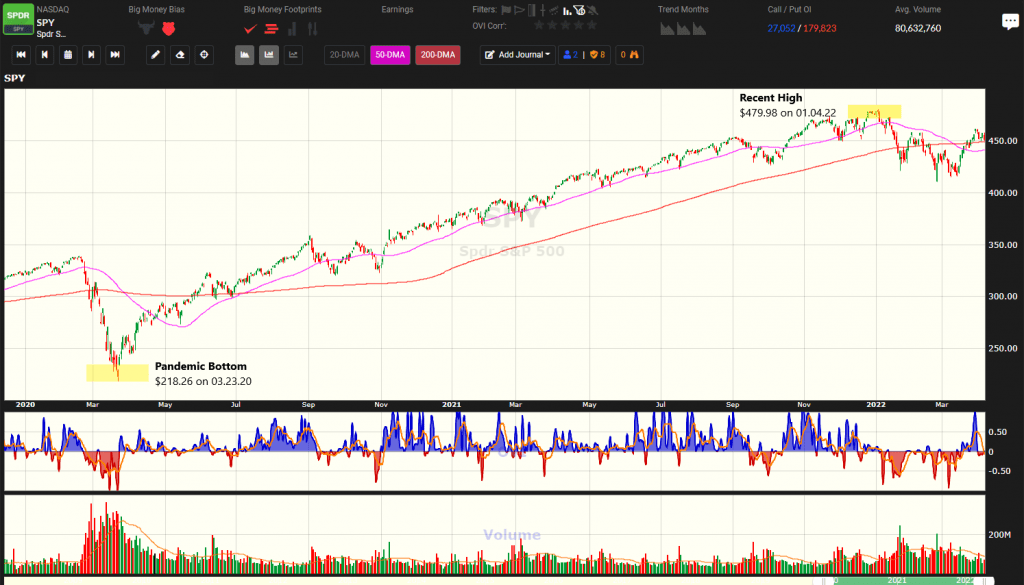

At the market low on March 23, 2020, the S&P 500 (SPY) had dropped nearly 34% from the record close set a little more than a month earlier.

From the March 23 2020 pandemic bottom at 218.26 to the January 04 2022 high of 479.98, the SPY had its best two-year rolling performance since 1937, according to Dow Jone Market Data.

By January this year, the Dow Jones Industrial Average was up over 87% from its low of 18,591.93. The Dow’s performance since the bottom also markets its best two-year rolling performance since 1987 according to Dow Jones Market Data.

The same goes for the Nasdaq, having risen by over 105% from its low of 6,860.67.

How To Take Advantage Of Such Moves

Once you establish that you can trade with higher probabilities, an excellent way of enhancing your performance safely is with options.

The key word here is “safely”, and if you trade them the right way, options can be a safe mechanism to leverage your advantage. More in my next blog about that.

The OptionEasy Miami Bootcamp is the ultimate way to learn about options, regardless of your experience. The Bootcamp hosts experience levels ranging from relative rookies all the way to professional money managers.

In conclusion, “Trade What You See” (TWYS) has to actually mean something. It should not be some pithy saying with no explanation.

In our ecosystem, TWYS means following the likely position-building activities of Big Money.

There may be other ways that TWYS could be interpreted, but Big Money is our way.

It has the advantage of being entirely logical, and with our patented technology that has a proven track record in the field, we stand by our interpretation with confidence that comes with deep long-standing results and R&D.

Glenn