This is the story of my ’emotional rollercoaster’ journey to becoming a wiser trader, and how I overcame the psychological pitfalls of trading in the stock market.

A Beginning Full of Hope

My trading journey began in 2013 as a long-term buy-and-hold private investor. I wanted to become financially free and hoped to make a secondary income from the stock market. I was also excited to put my analytical skills to good use with a background in actuarial science and finance from university.

I spent months analyzing various companies before I finally opened a brokerage account to place my first order. I thought I had the required knowledge to begin investing, but I lacked the practical experience of executing a trade. The various order terminologies on the brokerage platform were confusing and I remember feeling terrified when I placed my very first order to buy ten shares of Coca Cola (KO) at $38 per share.

When I saw how easily my orders were executed my confidence began to grow. I then placed more buy orders on a few other stocks such as John Deere (DE), Procter & Gamble (PG), and Microsoft (MSFT) because I wanted to build a diversified portfolio for the long term.

A couple of months after I started investing, the social networking site, Twitter (TWTR) announced their plans to go public (IPO) in September 2013. I wanted to own Twitter shares for the long term and buying them after the IPO seemed like a good idea. I failed to do the proper research necessary as I was only focused on the news. As a result, I ended up buying shares of a bankrupt company called Tweeter (TWTRQ) because I keyed in the wrong ticker symbol into my order.

I was one of the many investors who contributed to the sudden rise in the bankrupt company’s shares.

Fortunately, I didn’t have much capital at that point in time and only lost about $4.60 from this silly mistake. Following this experience, I decided to stay away from IPO shares.

Building My Trading Experience

I continued investing in the stock market for the next three years, and even though my portfolio did grow from my capital gains and dividend income, my returns were too low to be turned into a secondary income. Due to my limited capital, I was only earning about $30 in dividends every year. My hopes of relying on dividends as a secondary income were dashed.

This drove me to explore shorter-term trading opportunities in 2016. I started learning about technical analysis from Google and Youtube. I understood the concepts pretty easily but it was again the lack of practical experience that held me back from trading. After months of following several trading services, I decided to give trading a shot.

I started my trading journey using a leveraged product known as a contract for differences (CFDs). CFDs simulates the underlying stock price move and pays dividends. That seemed to fulfil my short-term and long-term trading goals. The lower capital requirement from CFDs as compared to an outright purchase of the company’s shares also made it much more affordable to me.

A Renewed Feeling of Optimism

Since CFDs are a leveraged product, I saw a huge rise in my trading account when stocks within my portfolio moved in my favor. This made me very optimistic about trading and I then started learning about using options. I got excited about using highly leveraged options strategies such as Out-of-the-Money and At-the-Money options in the hopes of accelerating my account growth.

Everything seemed to be working out when the stock market continued to rise to new all-time highs. I was thrilled at my account’s performance and began to look into intraday trading. I was attracted to the idea of generating huge profits from the stock market every single day. I looked into scalping and started dabbling in spread betting the futures market in 2017.

I had hopes of making big money from intraday trading since the futures market was open nearly 24/7. The first few months of day trading were exhilarating. I remember feeling euphoric when I banked in $1,000 from a day trade I made on the Dow futures. My confidence skyrocketed and I started increasing my trading capital and the number of trades I made each day.

Overconfidence and Excessive Risk-Taking

I grew overconfident in my trading skills and started chasing after stocks that I now realise were overextended, due to the fear of missing out (FOMO). I didn’t have a trading plan and my main goal was to place as many trades as I could every day using highly leveraged products and options strategies to grow my account.

Unfortunately, leverage is a double-edged sword when not used in a proper manner. A 200% growth one month would result in a 300% decline the next month when stocks moved against me. I started feeling anxious when I saw my account drop by 90% when the markets took a small dip in June 2017.

It was a sign that my trading approach was deeply flawed and I should adopt a proper trading plan to protect my account. However, I was in denial and refused to admit my mistakes.

Losses and Panic

I really started panicking when I saw half of my life savings wiped out when the markets dropped again in August 2017. I was trading blindly at that point in time. I shorted stocks that looked oversold because an “expert” on CNBC recommended it, and I made the deadly mistake of trying to catch a falling knife by buying every single dip on my favorite stocks.

This quickly turned into a full-blown depression because my account was then down by 300% due to overtrading and margin calls even though the markets had bounced off their lows by September 2017. It was very depressing to see all my profits turn into losses within just a few days and I decided to stop trading.

A Game-Changing Event: Guy Cohen’s OptionEasy Bootcamp, April 2018

As a final throw of the dice, I came across the WiseTraders system through Guy Cohen’s ‘Options Made Easy’ book. The book helped reinforce my background knowledge of how options work and I wanted to learn more about how the Options Volatility Indicator (OVI) worked. Hence, I enrolled for the Stocks Workshop event (now known as the WiseTraders Summit) in Dec 2017 and was impressed with the WiseTraders system as it was based on logic.

I immediately enrolled for Guy’s OptionEasy Bootcamp in Miami after the Stocks Workshop because I really wanted to learn how to use options to grow my trading account. I still wasn’t trading yet at that point in time because I was focused on learning how the OVI method works.

I attended the options event remotely from my home in Malaysia. It was a game-changer for me. Guy covered so many options strategies that I was mind blown by the endless possibilities of the various options strategies. Through the event, I finally understood why my strategy of using highly leveraged options to trade was not working. I also gained a much better feel for the type of option strategy that is best suited for my trading personality after the event.

I also decided to take advantage of the 1-2-1 coaching session that was part of the package that also included Guy’s software. My first session with Guy was in June, about six weeks after the event.

During this session, Guy analyzed my trading habits and noticed that I had a big problem with trading discipline. My biggest mistake was not having a proper trading plan.

Guy outlined a trading plan for me to follow and recommended I focus on just one or two basic options strategies before moving on to any of the more advanced ones like the synthetics.

He emphasized how to identify the optimal market conditions to trade in, and how to spot a high-quality trade setup during our session together. This has really drilled into me the need to scale back when markets are choppy, which led me to develop my own personal rule of taking a break from trading whenever I encounter three losses in a row.

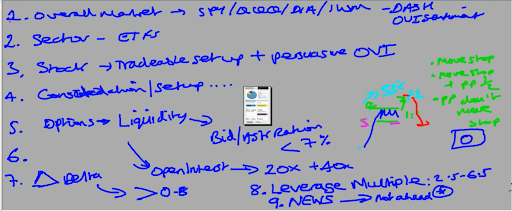

Guy’s proposed trading plan (see the original image from the session below) has given me:

- a clear trading routine to follow

- a preferred trade setup that I look for when selecting stocks to trade

- a specific options strategy that is best suited for my trading personality.

Even since this screenshot, Guy’s plan has evolved as his research and technology unveil new angles and opportunities, but the main principles are much the same.

My past experience has taught me a painful lesson about falling into the psychological whims of the market cycle when trading and I was determined to never experience that nightmare again.

How I Grew My Small Trading Account

Guy’s trading approach restored my faith in trading again and it has been the game-changer for me. I quickly saw that it is possible to see consistent returns from trading provided I follow the given trading plan. My biggest goal at that point in time was to use my trading proceeds to fund my travels as I really wanted to take a month-long backpacking trip to Europe.

Since I had nothing more to lose, I decided to put 100% of my focus on Guy’s OVI method. I only had $3,000 trading capital remaining but I was hopeful that I could double it within 12-months if I followed my trade plan to the letter.

I started trading again after my 1-2-1 session with Guy in June 2018. I was extremely cautious and focused on taking profits when my conservative first profit target (Guy calls it ‘P1’) got hit. It was challenging trading with a small trading account because I chose not to ride any windfall profits (‘P2’).

Nor was I able to trade many large-cap stocks, such as Apple and Microsoft simultaneously. But as I discovered, this limitation actually helped build my trading discipline as I simply could not afford to make any large mistakes with such limited capital.

I focused only on trading stocks that met my preferred trade setup and risk appetite. As a result, for the first time in my life, I started seeing consistent returns in my trading account.

I started to feel a sense of control that I had never previously experienced in any of my trading adventures.

This enabled me to fulfil a long-held ambition of funding a month-long backpacking trip to Europe with the proceeds from my trading. That was in December 2018, just six months after my 1-2-1 with Guy.

Over three years later, I have 15X’ed my original small trading account and because of my consistency Guy invited me to join his WiseTraders team as a part-time Mentor.

Feeling in Control with the WiseTraders Method

I had spent five years experimenting on my own before I finally found a trading system that works for me, and this is all thanks to Guy’s method, tools, and that 1-2-1 session.

I have made a lot of mistakes since I first started to dabble in the stock market in 2013.

Looking back at my trading journey now, I realize that most of my mistakes could have been prevented, but perhaps that is an essential part of the successful trader’s journey.

It is said that the biggest epiphanies happen when someone hits rock bottom. Maybe that was the catalyst for me because before that I simply wasn’t willing to listen or learn.

One of the biggest changes I have undergone is a feeling of absolute control when it comes to the markets.

Guy emphasized that stocks have to prove their worthiness (by way of his favored setups and market conditions) to me, as opposed to me chasing everything that moved.

This was a completely different way of doing things, and it means that I am now in control of what I trade and how I trade it. I have now experienced the thrill of being patient. I also know when conditions are right I can pull the trigger and I will continue to increase my account size.

There is no joy anymore in gambling when conditions aren’t optimal.

I am certain that with the help of the right approach, tools, a trading mentor, and a determination to follow guidelines, anyone can do what I have done. I was almost a write-off, and now I love the feeling of quiet, confident control.

I have learned so much since I joined WiseTraders in 2018, and can now say that I am no longer a victim of the emotional cycles of the stock market.