Latest News

New Year Power Play

Wishing you a very Happy New Year and a special 2026 ahead. We’re certainly going to play our part here at WiseTraders, with new upgrades and research that will bring huge improvements in all areas. My last review talked of Mild Christmas Cheer and that profits were not to be taken for granted. That’s pretty much exactly how it played out, with many stocks breaking out to P1 levels before retreating. We’re pretty much in pre-earnings now, and with the world in a variety of geopolitical dramas, it’s not going to be a shock for some dramas to unfold in the stock market too. Again, I’ve kept the recording to 30-minutes this week … I could get used to this! Market Outlook: The indications suggest mildly bullish but without huge conviction. The SPY and QQQ are divergent again to the

Market reviews and blogs

Your best source of investment news from WiseTraders and Guy Cohen.

Mild Christmas Cheer For The Shortened Trading Week Ahead

🎅🏻 Wishing you a very Happy Christmas during this week ahead. 🎅🏻 Interestingly, while last week’s highighted stocks were predominantly

Why There Are Mixed Fortunes Right Now

Last week’s Stocks VIP Summit was our best yet, with significant portions dedicated to practical exercises using our Platform. Next

Why A Short Term Bounce Is Likely

There are just 2 weeks to go until our Stocks VIP Summit on 6th December. This is where you get

Informed Trader eLetter – OVI Report

Hi Everyone

Mixed news is the how this earnings will be remembered. Some stocks have been flying and others have been hammered! Let’s start with the main indices: SPY (S&P…

In the thick of Earnings Season – see AAPL

So last week we had GOOG causing shockwaves. This week it could be AAPL’s turn on the 20th. Now this is one I have mixed feelings about … here’s why: You’d be a brave soul to eve…

OVI Charts – QQQQ is now QQQ

A quick note to alert you that the QQQQ has gone back to its original symbol of QQQ. Normally that wouldn’t be an issue, but the new symbol needs to be annexed to the old symbol within our OVI c…

No Surprises Whatsoever

Hi Everyone.

As horrific as the events in Japan have been, make no mistake, the markets were going to fall anyway.

The OVI on the S&P and Nasdaq has been pointing the way for almost …

OVI Market Update 10 March 2011

Hi Everyone

No surprises with the market action today – the OVI has been pointing the way for a while now, and the charts have been wobbly too.

Before I give more details, please do folllow me o…

Latest Update from Guy

Just a quick message to give you an update on progress.

The Markets First, just to say the markets are looking increasingly sloppy and the OVI is bumbling just under zero on the S&…

The Power of the OVI …

In this short video I explain how the OVI works so well, how it worked a treat on two stocks this weekend, and how you can use it moving forward.

[usercontrol: /User controls/CamtasiaPlayer.ascx…

OVI Market Update 16 November 2010

Hi Everyone

The markets have been due a well needed rest and are taking a good smack right now.

While I’m very concerned about the repeated need for Quantitative Easing and its long term effect…

Quantitative Easing Defined

Hi Everyone

The markets started to wobble as the S&P got dizzy from breaking its year highs. I’m thinking that this will be the start of some further wobbles as the market makes up its…

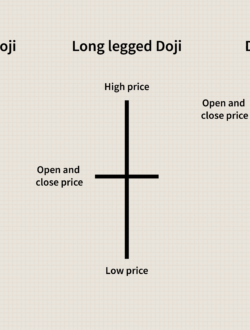

Doji City

Hi Everyone

Over the weekend I said the markets were likely to rise today and luckily for me they obliged.

However, the Nasdaq and S&P are both displaying Doji bars today after breaking int…