Latest News

Big Seven Holding the Dam

It’s just a few days until our big Orlando Bootcamp! Get ready for further chart upgrades/fixes and new “toys” for attendees before and after the event that will transform the speed at which you can find optimal options ideas … literally in a single click directly from the charts! Last week the Foundation Day was a great success, where I went through the basics and theory behind options. We recorded it, so even if you missed it but want to attend the Bootcamp, you can view it later on. Starting this Saturday, the two-day Bootcamp will emphasise the PRACTICAL! You’ll be using our new tools, guided by me and my team where each exercise is easy to follow step-by-step. Soon after the event we’ll be releasing a brand new education suite that has been

Market reviews and blogs

Your best source of investment news from WiseTraders and Guy Cohen.

Is This The Real Thing Or Just Another Pullback Tease?

Just two weeks until our big Orlando Bootcamp! Get ready for further chart upgrades/fixes and new “toys” for attendees in

Keep Your Opinions At The Door!

Just three weeks until our big Orlando Bootcamp! We have a flurry of upgrades and new “toys” for attendees that

Market’s Reaction to FOMC Seems Odd

I’m not a macro guy, mainly because none of the macro experts can ever agree on anything, and so much

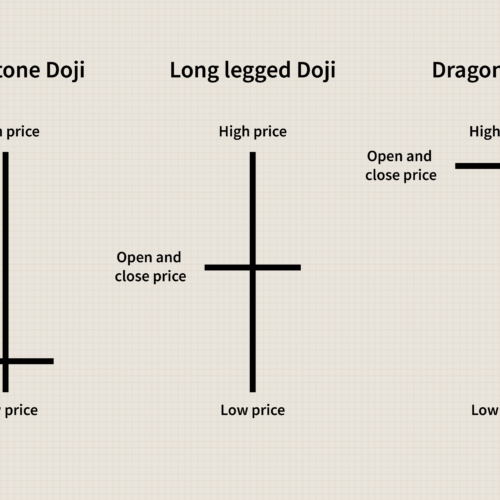

Beware the Doji

Hi Everyone

Just a quick note to say that Doji type long-tailed bars have formed on the Dow, Nasdaq, S&P and a number of leading stocks including AAPL, GS, AMZN and WYNN to name but a…

Is the Recession Really Over?!

Hi Everyone

A concerted move up yesterday throughout the board as the US “officially declares the end to the recession” – notice I put that in parenthesis!

First let me say that I don’t ha…

Charts are Bullish – OVI is shy

Hi Everyone

Ok, we have some divergence with the markets looking bullish (with nice bull flags forming) but the OVI having turned down on the S&P and the Nasdaq.

Let’s put this in context. …

GLD Update

Hi Everyone

GLD finally broke out today meaning if you were patient, you’d be in a trade right now.

It’s been a pretty dramatic breakout and the OVI never got into negative territory even…

Extra Note on GLD

Hi Everyone

I forgot to mention GLD, which is a Gold ETF …

Having been bullish for several weeks now, GLD stands on the precipice of a new breakout from its June highs.

The OVI w…

OVI Market Update 03 September 2010

Hi Everyone

Impressive work by the markets on Friday but remember, in order to trade an upswing we need one of two things present before we can activate a trade safely:

(a) A consoli…

No breakout, no losses

The Markets

One of the key advantages of trading breakouts with a robust trading plan is that if a flag or channel doesn’t break out in the direction of the trend, you won’t lose because your trade wa…

Strong bounce … for now

A strong bounce off the short term support today so far. There’s still a while to go today, but keep things in perspective, we just had the worst August in 10 years! Employment is still a …

Your OVI Market Alert, 26 August 2010

OVI has been negative for the QQQQ over the last month and isn’t fairing well either for the S&P. The Dow OVI is neutral but as I’ve said before it does tend to be more bullish than the othe…

Your OVI Market Update, 20 August 2010

Earnings season is pretty much over now, the OVI is negative on all indices, and bearish patterns are in the ascendancy.

There have been some fantastic bear flags recently that many of us have prosper…